Chinese just wait for share price to depress?

How come Tianqi paid US$4b for 23% of SQM?

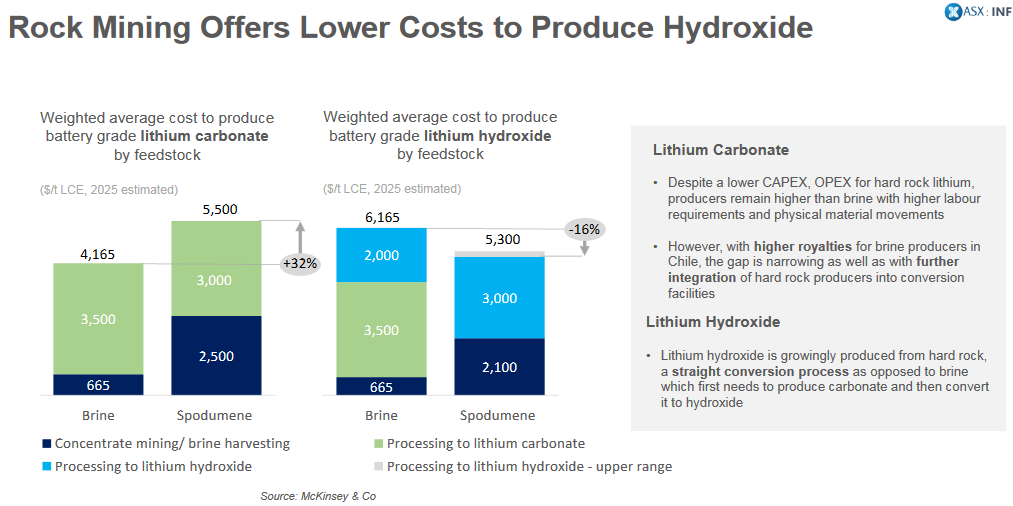

Lithium hydroxide demand growth set to surge 43%pa

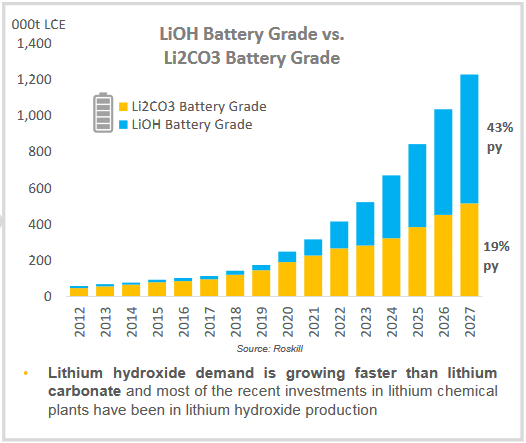

Source: Infinity Lithium company presentation

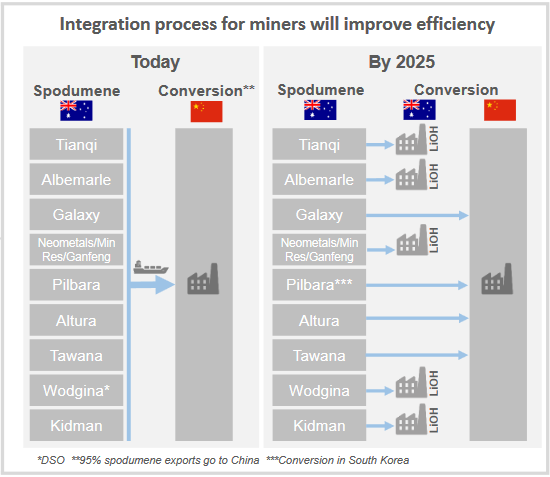

2) Vertical integration

Source: Infinity Lithium company presentation

2) Vertical integration

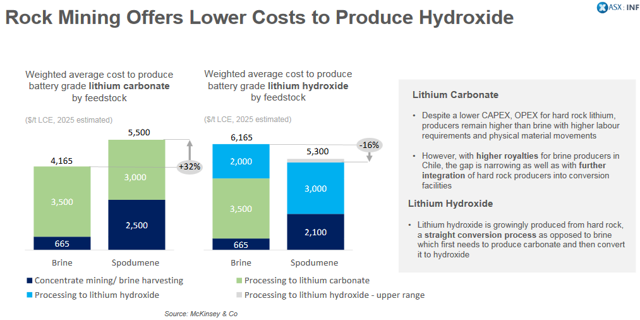

A growing trend is for the lithium miners to get involved with a larger part of the lithium supply chain ("vertical integration"). The main example going on recently is for various spodumene producers and near-term producers building or planning lithium hydroxide conversion plants. The lithium miners will act to take a larger part of the value chain and also decrease their overall cost to produce the lithium hydroxide needed for EV batteries. My list and the chart below give a great guide as to the key players so far.

Notice that Western Australia dominates for now, but this could expand to other regions such as the Northern Territory of Australia, or James Bay Canada. I think the strategy makes good sense, and therefore the names below should also appeal to investors.

Lithium hydroxide plants planned or under construction

- 2019 - Kwinana WA (2 x 24ktpa stages) - Tianqi Lithium - Under construction.

- 2020 - Shawinigan near Montreal Canada (23ktpa) - Nemaska Lithium (OTCQX:NMKEF).

- 2021 - Kalgoorlie WA (initially 10ktpa) - Neometals (OTCPK:RDRUY) [ASX:NMT]/? - Feasibility stage, may start by 2021.

- 2021 or after - Kwinana WA (45ktpa) - SQM (NYSE:SQM)/Kidman Resources (OTCPK:KDDRF).

- 2021 or after - Near Bunbury WA (5 x 20ktpa stages) - Albemarle (NYSE:ALB)/Mineral Resources (OTCPK:MALRY) [ASX:MIN].

By 2025 many Australian lithium spodumene miners will have conversion facilities in Australia

Source: Infinity Lithium company presentation

Source: Infinity Lithium company presentation

Note: Neometals is in the process of selling out of Mt Marion to the other two partners.

3) Takeovers, mergers, and acquisitions of promising lithium juniors or small lithium producers

In 2019, I expect to see a lot more takeovers, mergers, and acquisitions of promising lithium juniors or small lithium producers due to the enormous valuation opportunity that has now presented after the 2018 EV metal miners' rout. Two examples from December give an idea of what is ahead.

December 14, 2018 - Albemarle agrees to acquire a 50% interest in Mineral Resources' Wodgina hard rock lithium project in Western Australia for

US$1.15b, and form a joint venture with MRL to own and operate the Wodgina Project to produce spodumene concentrate and battery grade lithium hydroxide.

December 21, 2018 - Neometals agrees the sale of Mt Marion equity for $A104 million and retains offtake rights. Neometals to sell its Mt Marion project equity to Ganfeng and Mineral Resources for ~A$104 million.

As for specific names or deals, I can only throw in a few ideas. To begin with, I see some consolidation likely in the Argentina lithium juniors (many names so many options). Galaxy Resources (

OTCPK:GALXF) may partner at Sal De Vida (POSCO (

OTCPK KXFF

KXFF)?). Perhaps a cheap Australian spodumene producer or junior (Altura Mining (

OTCPK:ALTAF) [ASX:AJM], Core Lithium (

OTCQB:CORX) [ASX:CXO], Sayona Mining (

OTCPK MNXF

MNXF) [ASX:SYA], or Hannans (

OTC:HHNNF) [ASX:HNR]) may be bought out or merged? If history is any guide, then the big lithium producers (Albemarle, SQM, and the Chinese Ganfeng Lithium [SHE:002460] [HK:1772], and Tianqi Lithium Industries Inc. [SHE:002466]) will be the likely suitors. Or thinking further ahead perhaps 2019 will be the year the big diversified miners (BHP Group (

BHP), Rio Tinto (

RIO), or Vale (

VALE)), or some oil majors (Shell (NYSE:

RDS.A) (NYSE:

RDS.B), Chevron (NYSE:

CVX), BP (

BP), Eni (NYSE:

E), Total (NYSE:

TOT), Sinopec (NYSE:

SHI), Exxon Mobil (NYSE:

XOM)) or the Saudis make a big move into lithium. Certainly if the latter happens, it could be a huge catalyst for the sector.

4) Lithium demand versus supply

Demand

Provided electric vehicles sales continue to grow strongly each year, which seems increasingly likely (read "

The EV Boom Just Keeps Getting Bigger - Update End 2018"), then lithium demand should also increase rapidly. My model is forecasting a 4.5-fold increase in lithium demand from end 2018 to 2025.

My model - A 4.5-fold increase in lithium demand in the next eight years

|

Column 1 |

Column 2 |

Column 3 |

Column 4 |

Column 5 |

Column 6 |

Column 7 |

Column 8 |

Column 9 |

| 1 |

|

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| 2 |

Electric car market share[/B] |

2.2% |

3.5% |

5% |

7% |

9% |

11% |

13% |

15% |

| 3 |

Lithium demand (ktpa) |

294 |

380 |

500 |

635 |

785 |

947 |

1,126 |

1,315 |

| 4 |

Increase (ktpa) |

|

86 |

120 |

135 |

150 |

162 |

179 |

189 |

Note: Lithium demand assumes from 2020 the average electric car has an average 50kWh battery with 45kg of lithium carbonate equivalent (LCE), and my model also allows for lithium demand from e-buses, e-bikes, e-trucks, e-ships, e-planes, energy storage, and conventional lithium demand areas (electronics, ceramics, glass, etc.).

Confirming the demand wave coming is the

Benchmark Minerals Megafactory update: Currently tracking 66 plants on the @benchmarkmin tracker, rapidly approaching 1.4TWh capacity by 2028.

Lithium demand set to grow 6x over the next 10 years

Source: Infinity Lithium company presentation

Supply

Source: Infinity Lithium company presentation

Supply

Lithium supply traditionally struggles to match forecasts due to the difficulty of bringing on new lithium supply.

https://seekingalpha.com/article/4247506-2019-lithium-themes-watch?page=4