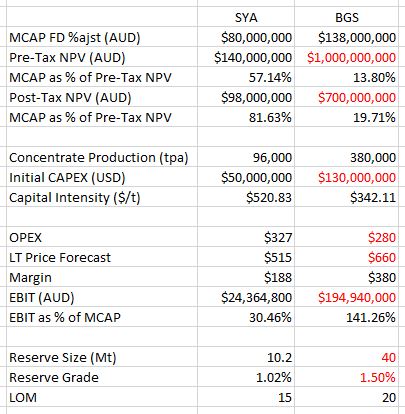

Here is a rough comparison between the two companies. The figures in red are my ball-park speculation for figures that will be delivered in the PFS due next week, they should be pretty close +/- 20%

I determined fully diluted market cap by summing all shares and options on issue (including what will be issued in SYA's current CR) and multiplying by the current share price. In BGS case, I also corrected for % ownership.

SYA didn't advise post-tax NPV - which is a red flag in itself, so I multiplied the pre-tax NPV by 70% to determine post-tax NPV.

Mining projects are typically discounted by 10% as a minimum, SYA being cheeky to help boost their numbers. If SYA discounted @ 10%, the NPV would be lower again.

I don't see how you could expect the company to grow beyond $100M MCAP in the near term? Just because a director on the board grew another company to $650M does not mean that this one has scope to grow that much. SYA is currently trading at >80% of its post-tax NPV compared to BGS trading at ~20%.

Based on company announcements, BGS will produce 4 x as much concentrate per annum than SYA due to having larger plant throughput and a higher grade resource.

Although BGS has higher initial CAPEX, this enables the project to command such a high NPV. As they say, you need to spend money to make money.

However, BGS capital intensity is much lower than SYA indicating that BGS is getting more bang for their buck by building the plant, largely due to the superior resource and processing plant yielding much more concentrate per year than SYA.

Earnings were determined by multiplying margins by the quantities of spodumene the companies expect to produce per year. BGS has a lower OPEX and can produce a concentrate >6% lithium which commands premium pricing. SYA has a higher CAPEX and can only produce 5.75% concentrate, therefore SYA advised that they expect to receive $515/t for their product on a long-term basis.

This results in BGS theoretically producing 8 x the earnings of SYA with double the margins.

On reserve comparison, BGS will likely prove something in the ballpark of 40Mt @ 1.5% Li2O. This is 4 x the size of SYA's reserve at a 50% higher grade. In addition, the size may conceptually double again, as a large resource upgrade is due by the end of the month.

- Forums

- Commodities

- SYA BGS comparison

Here is a rough comparison between the two companies. The...

-

- There are more pages in this discussion • 82 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)