This report was taken from SA website

Description:

MMA Offshore is a leading operator of offshore supply vessels. Its key asset bases are a relatively young core fleet of 28 offshore supply vessels. The company is headquartered in Perth, Australia, with key operations in Australia, Southeast Asia, and the Middle East.

History:

Let's see how MMA got into trouble in the first place.

The 2014 oil collapse pushed explorers and producers to reduce their spending on offshore fields. This left MMA, and competitors, without much work to do. To make life more difficult, the last few years also saw plenty of new vessels, ordered when the oil price was above $100 per barrel, finally ship out of the yards. MMA ordered vessels too, and spent around $450m acquiring a Singaporean competitor. MMA started a fleet rationalization program that never finished it because of dire market conditions.

In 2016, it ended up in a period where its debt facilities started breaching their covenants because the EBITDA was too low. The company was struggling to make principal repayments in accordance with facilitiesand became distressed. The stock price nosedived from A$2.40 at the time of acquisition to a low point of less than A$0.20.

Present:

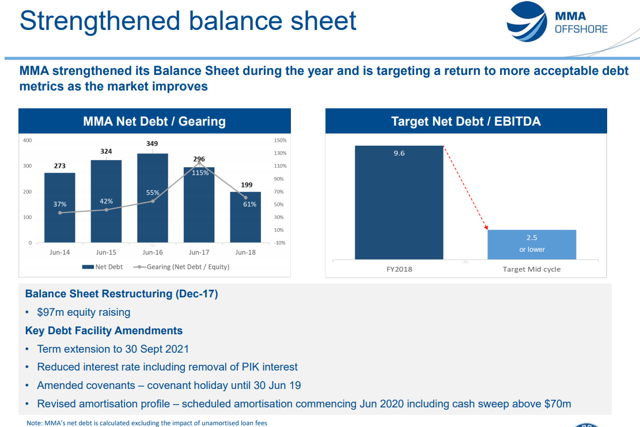

Following asset sales and recapitalization, the company is now back into a comfortable balance sheetposition as shown below.

Source: Company presentation

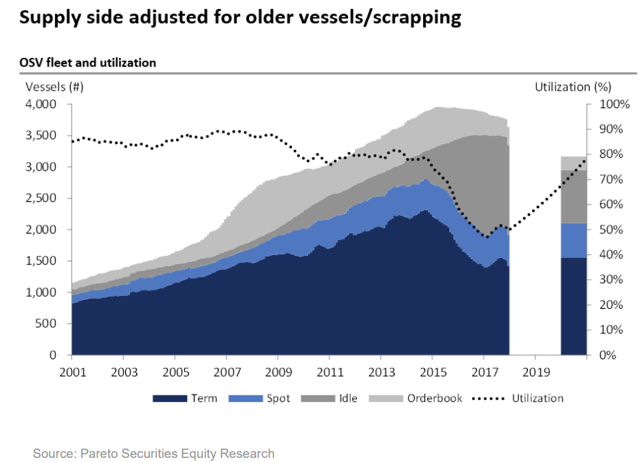

For 15 years prior to the oil collapse, offshore support vessels were in use 90% of the time, against only 57% now. No vessels have been ordered in the last few years, and many of the currently waylaid vessels are too old to return to work. Meanwhile, offshore spending needs to rise to maintain oil supply.

In terms of market recovery, one needs to consider the state of the worldwide offshore supply vessel fleet. The number of working vessels has significantly declined between 2001 and 2017 – from upward of 3,000 to about 2,000 vessels. And there are a substantial number of idle vessels.

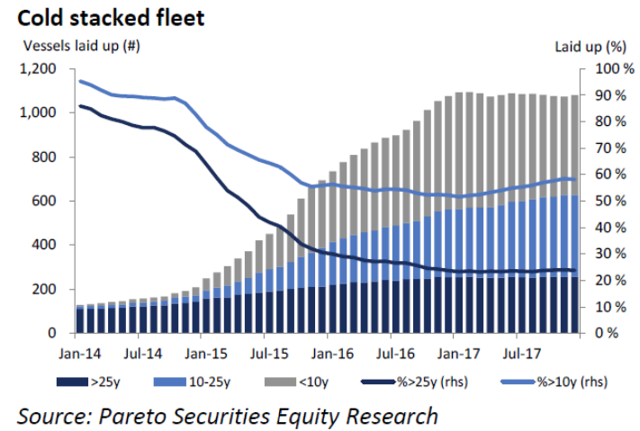

However, the situation is not as bad as it seems because a significant proportion of the global fleet are old vessels and much of this underutilized fleet has been laid up for a long time. Once offshore vessels get laid up, they’re not maintained properly so it costs a lot to bring them back into utilization and up to operating.

That means a significant portion of this fleet is not coming back. Of the approximately 1,200 laid-up vessels in the global fleet, around 20% are more than 25-plus years old, which are less likely to come back. 60% of which are more than 10 years old. Thus, a relatively balanced vessel market may not be that far away, especially with expected recovery in offshore activity.

Upside potential from the recovery in offshore oil and gas capex:

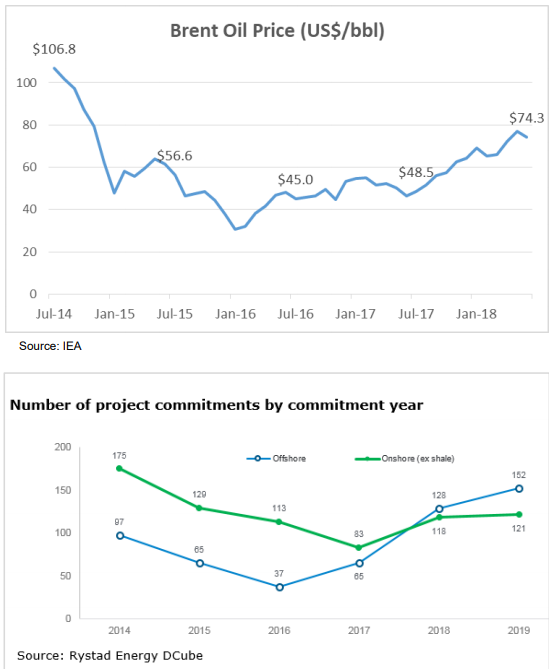

Re-rating of the company is likely once the company starts reporting higher EBITDA with its specialized young fleet. Key leading indicators for MMA’s earnings are oil price and offshore projects.

Offshore vessels are used in exploration and production as well as in the construction of fields. Therefore, oil and gas capex is a key driver. For the first time since the downturn in oil prices, there has been a recovery in oil and gas capex as shown below.

- Forums

- ASX - By Stock

- MRM

- Seeking Alpha analysis

Seeking Alpha analysis

-

-

- There are more pages in this discussion • 1 more message in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)