Opinion: Ripple’s Price With Visa or Mastercard Integration

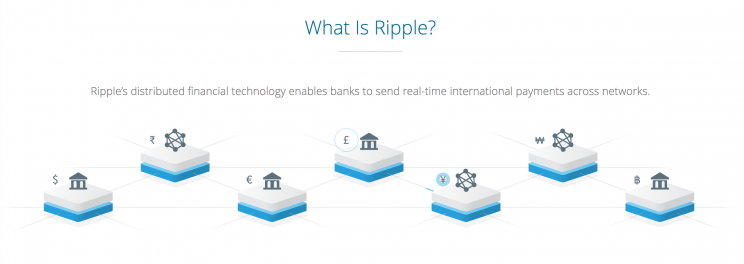

Ripple (payment network) has been at the centerpiece of the overarching Cryptocurrencies market for about a year now and currently sits at number 4 behind Bitcoin Cash (BCH) (Bcash) — not far behind either. Ripple is aiming to bridge the remittance cost-gap between institutions across the globe — Financial Institutions. something that has torn the cryptocurrency community due to the decentralized nature /ideals of the markets.

Why has Ripple been such a major topic in the cryptocurrency community?

Well, take a look at the image below. I don’t have a clue when this picture was created, but Bitcoin fees and Credit Card Processing fees continue to take center-stage topic as more and more retail consumers enroll in the markets. Why fees? I thought the magic of Bitcoin was in it’s Decentralised Organisational Structure? It is, still. Bitcoin will not be regulated by any government and cannot be shut down unless governments in every country across the globe shutdown electricity to every individual supporting the network via Bitcoin Mining. More below.

The reason Bitcoin still has such high-fees is because the network is currently developing different technological solutions to solve this problem, allowing Bitcoin to scale. Instead of staying patient, a faction of the original Bitcoin community led by Roger Ver and Jihan Wu decided to continue supporting the old fork which, today, is known as Bcash (short for Bitcoin Cash), in an effort to expedite the process of Bitcoin becoming a tool for payment processing and Remittances.

Looking above at the original Bitcoin white paper by Satoshi Nakamoto, we cab see the title clearly states:

‘Bitcoin: A Peer-to-Peer Electronic Cash System’

Key-word = Peer-to-Peer. While Bitcoin Cash is still a decentralized Blockchain (database), it is very, very heavily influenced by a centralized force of commercial Bitcoin miners. This takes away the original peer-to-peer ideals out of the BCash network because it is so centralized — the miners are controlled by a couple people which gives a major threat to 51% attacks on the Proof Of Work (POW) Bitcoin Network.

51% attacks are prevented by having a majority of the network’s mining hash power distributed across individuals as opposed to running ASICS-powered mining rooms in one building, centralized. Since BCash is a centralized blockchain network, it can be compared with Ripple — another centralized blockchain aiming to create a remittance system for institutions who will ultimately allow their customers to make low-cost remittances through the Ripple payment network.

Now that we know the difference between Bitcoin and Bitcoin Cash when it comes to the nature of the blockchain, we can look at Ripple through a similar lens that we look at Bitcoin Cash through — a company using blockchain technology strategically to increase the quality of service for companies using their service, but in a centralized manner.

For the purpose of this article, it’s important to know the difference between a truly decentralized blockchain network and one that is centralized, but using blockchain technology to power the network. The hurry to become a payment processing network will likely impede BCash’s growth progress because security is far, far more important than being first-to-market. Look at the recent Equifax Data Leak (September 2017). This is one of, if not THE, world’s biggest Credit Rating Agencies in the world — the WORLD.

You can look into the statistics yourself, but over 150 million customer’s information was stolen — yours, mine, your parents, etc. This is an issue Blockchain Technology aims to solve by using Public-key Cryptography to thwart hackers’ ability to steal mass amounts of data in one fowl swoop. As soon as the Lightning Network is established and Atomic Swaps become more stable, the Bitcoin Economy will be easily integrated into other blockchain networks as it continues to become more efficient.

A major lack of patience is what caused the Bitcoin Cash chain to continue running after the Bitcoin Cash Hard-Forks From Bitcoin (August 2017) — that and the sometimes uncontrollable characteristic of human-greed.

Anyway, let’s dive into Ripple and how this centralized blockchain network may have the ability to garner Visa, MasterCard’s, or any other Credit Card Processing company’s business, and what type of price movement this could create for the Ripple (payment network).

One of the pictures above displays that Ripple already has a much, much lower fee than the distributed Bitcoin network and Visa’s current fee schedule. Even Bitcoin’s currently inefficient network beats Visa’s payment processing fees. Ripple has a highly-dedicated team of Finance and experienced technology professionals fueling their growth and they are either aiming to integrate with credit card processors like Visa OR simply take their market-share. Either way, it should be interesting to watch Ripple’s price in the process!

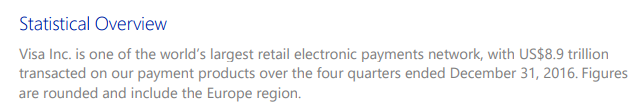

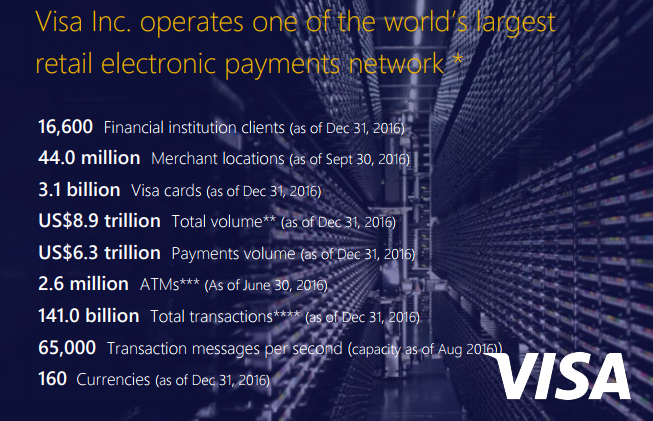

The sheer statistical figures below give us some interesting potential scenarios that I will have fun projecting below in this article!

Okay so 16,600 Financial institution clients…do we really need to go through every single stat? I don’t think so…we all know Visa owns a significant portion of the market so let’s have fun diving into potential Ripple projections!

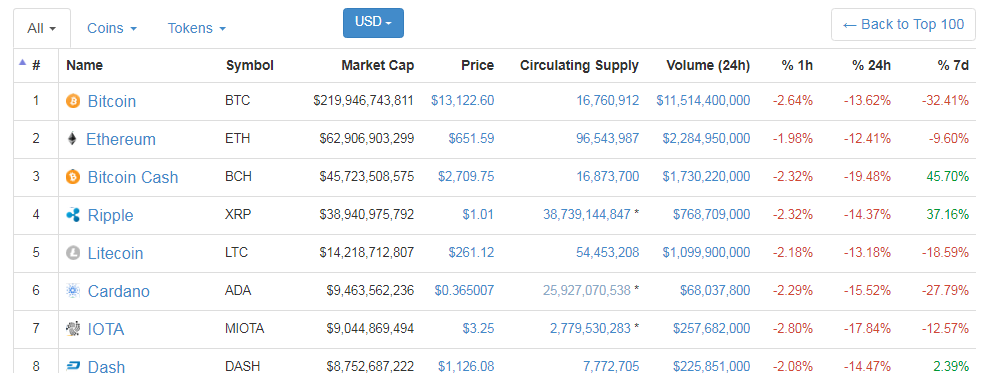

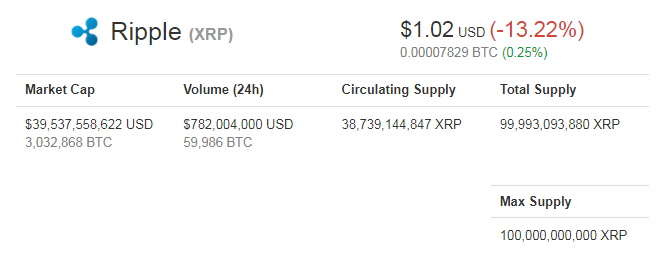

According to CoinMarketCap’s Ripple profile, there are currently 38,739,144,847 XRP in circulation with a total of 100 billion XRP in max supply, held by Ripple leadership and a fund of XRP used to ease the price growth of XRP as the company increases the volume and attention on their products. I will keep all figures the same as they are now in the projections below:

38,739,144,847 XRP.

$8,900,000,000,000 is Visa’s yearly total payment processing volume.

Now, keep in mind that Ripple will be used for payment PROCESSING. Meaning, Ripple will not always be held for the entire time it is being used to send value, right? For example, you or I might send U.S. Dollar to somebody in Europe where the USD is instantly converted into XRP, sent to the final destination at a bank in Europe, and then settled in Euro (currency) or the proper tender in the country sent to. However, Visa will not be the only provider that would use Ripple, it would be major financial institutions like Goldman Sachs or JP Morgan and other behemoths.

Since Ripple is a Digital Currency/Virtual Currencies, financial institutions and especially Assets Under Management institutions can add it as an Asset Diversification strategy in their client Portfolios. So we don’t know how much volume will be transacted in XRP by these institutions, so let’s have some fun!

$8,900,000,000,000 ÷ 38,739,144,847 XRP

= $229.742 XRP.

Kind of cool to think about, heh? The equation above is IF Ripple’s XRP captured ALL of the value of the Visa payment network, something unlikely to occur. However, as mentioned, Visa isn’t the only company Ripple can serve. What about Mastercard?

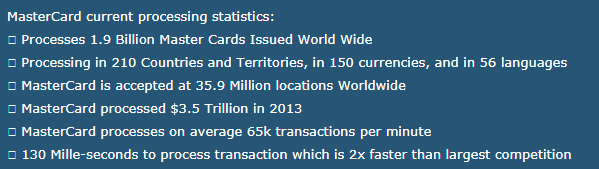

Interestingly, I could not find a single number that made sense to include in this article because one source says that Mastercard was processing $5.5 trillion in transactions as of 2003 and another source (image above) says 10–years later, in 2013, Mastercard is processing $3.5 trillion — companies do not usually shrink over time, but maybe Visa or other payment processors took some Mastercard volume? I don’t know, but let’s use the $3.5 trillion figure from the image above.

$3,500,000,000,000 ÷ 38,739,144,847 XRP

= $90.35 XRP

If, somehow, Ripple was able to capture all of the value of both Mastercard and Visa processing volume, XRP price might look something like below:

$3,500,000,000,000 + $8,900,000,000,000

= 12,400,000,000,000 ÷ 38,739,144,847 XRP

= $320.09 XRP

Keep in mind, the Assets Under Management (AUM) market is currently a $71 trillion market as per PricewaterhouseCoopers (PwC)’s Assets Under Management 2020: A Brave New World report, and expected to grow to $101 trillion by 2020. Considering Mastercard and Visa’s payment processing equates to something like $12.4 trillion in annual volume, that’sjust a drop in the bucket compared to the large and separate $71 trillion AUM market.

What if, say, all major asset funds used the ‘5% rule’ to diversify into 5 different major currencies, one of them being Ripple’s XRP? This assumption means that 1% of the overarching $71 trillion AUM market share would go to Ripple’s XRP.

0.01 x $71,000,000,000,000

= $710,000,000,000 ($710 billion)

Just the $710 billion would increase the $320.90 XRP price by:

$710,000,000,000 ÷ 38,739,144,847 XRP

= $18.33 XRP

$320.90 + 18.33

= $339.23 XRP

Remember, PwC projects the AUM market to reach $101 trillion by 2020, just 2-years away. What might this $18.33 price increase be if it were 1% of a $101 trillion market?

0.01 x $101,000,000,000,000

= $1,010,000,000,000 ÷ 38,739,144,847 XRP

= 26.07 XRP

$320.90 + 26.07

= 346.97 XRP

These are some pretty ‘brave’ and potentially over-zealous projections to make for Ripple’s XRP price and is not meant to be taken as a forecast of what will happen or advice for that matter. You, me, nor anybody else truly knows what will happen in the future of this financial revolution we are currently in the process of experiencing and are an integral part of. However, the dynamics discussed in this article are potential forces that will affect the price of XRP in the potentially near-future.

If you’re interested in trading Ripple’s XRP, you can find it at the following exchanges:

Please clap for this article and follow my blog as I continue to write about various thought-provoking topics in the cryptocurrency market! Let’s grow our cryptocurrency community

Below are some resources for beginning cryptocurrency enthusiasts or others interested in something new:

This is not meant to be Investment Advice and is just a fun display at speculation/forecasting what could happen with this revolutionary new cryptocurrency that aims to disrupt the payment processing space. Do your own Due Diligence before making an Investment Decisions.

- Cryptoversity by Chris Coney — The Online School That Pays You To Learn About Bitcoin, Crypto-currencies and Blockchains

- HitBTC Exchange — major exchange, access ICOs and multi-currencies.

- CoinTracking — Your personal Profit / Loss Portfolio Monitor and Tax Tracker for all Digital Coins

- Changelly — as easy as purchasing cryptocurrency gets — watch the exchange rate.

- CoinMate.io — Bitcoin arbitrage made easy.

- CEX.io — Buy Bitcoin w/ credit card, ACH bank transfer, SEPA transfer, cash, or AstroPay. Credit purchases are instant.

- CoinPayments — Receive payment via 70+ different cryptocurrencies — the crypto-PayPal.

- CoinMama — purchase Bitcoin and Ethereum w/ credit/debit cards & using cash through WesternUnion on their platform.

- Ledger Nano S — multi-cryptocurrency cold hardware wallet supporting Bitcoin forks. Keep your coins safe and offline.

- Kucoin — new exchange with its own token used to split exchange fees with holders, daily. Only exchange with NEO trading pairs too.

- Binance — 150+ cryptocurrencies with its own token used to pay exchange fees on the platform and give perks to traders on their platform.

Sources:

https://keepingstock.net/opinion-ripples-price-with-visa-or-mastercard-integration-6e723f7936d5

- Mastercard Fourth-Quarter & Full-Year 2016 Financial Results

- https://usa.visa.com/dam/VCOM/global/about-visa/documents/visa-facts-figures-jan-2017.pdf

- https://www.pwc.com/gx/en/asset-man...t-management-2020-a-brave-new-world-final.pdf

- https://bitcoin.org/bitcoin.pdf

- Assets Under Management — AUM

- Do You Know the 5% Rule of Investing?

- Forums

- International Markets

- Ripple-XRP

Opinion: Ripple’s Price With Visa or Mastercard Integration...

-

- There are more pages in this discussion • 209 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)