https://www.bloomberg.com/news/arti...ard-100-is-just-what-electric-car-makers-need

Hyperdrive

Oil’s March Toward $100 Is Just What Electric Cars Need

A record number of new electric models will hit the market next year as consumers face higher gasoline prices.

By

Jeremy Hodges

,

Oliver Sachgau

, and

Ania Nussbaum

4 October 2018, 09:00 GMT+10Updated on 5 October 2018, 00:25 GMT+10

Oil’s march toward $100 a barrel is coming at just the right the time for auto makers investing billions in the switch to electric cars.

Fuel prices reached a four-year high last month, concentrating consumers’ minds on the relative costs of internal combustion versus electric motors. For companies preparing to bring a record number of electric and hybrid models to market in 2019, oil’s rally could turbocharge demand.

“The higher the price of oil the more tailwind we’re going to have behind electric cars,” Carlos Ghosn, chairman Renault SA and Nissan Motor Co. said at the Paris Motor Show on Wednesday.

The Audi E-Tron SUV shown during a launch event last month, part of the crop of electric vehicles that could benefit from higher oil prices.

Photographer: David Paul Morris/Bloomberg

As production of the Tesla Inc.’s Model 3 grabs all the attention, carmakers in Asia, Europe and the U.S. plan new models across all market segments in 2019, from cheap city runabouts to high-performance roadsters.

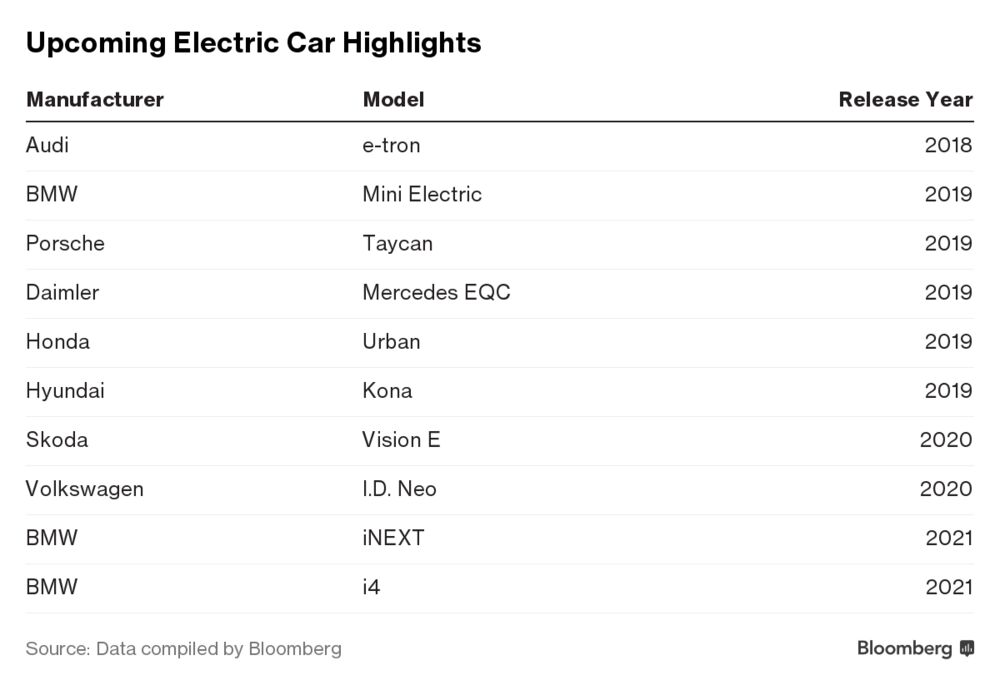

Germany’s car giants are all readying new models. Audi is slated to start selling the e-tron sport-utility vehicle later this year, while Mercedes will follow with the EQC in 2019. BMW’s Mini unit also plans to release the much-anticipated Mini Electric hatchback.

In Japan, sales are like to get a boost from the release of Honda’s Clarity Plug-In Hybrid and Urban EV models. Nissan will start selling a longer-range version of its best-selling Leaf. And in China, which accounts for almost half of worldwide sales, domestic producers like BYD Co. and BAIC Motor Corp. will extend ranges as the industry prepares the possible arrival of Tesla Inc. and other foreign manufacturers.

Data compiled by Bloomberg

Even ultra-premium brands are getting in on the act. Aston Martin has plans for battery-powered Rapide sports car, complete with a top speed of 155 miles per hour. Porsche will sell a two-seater model without internal combustion, the Taycan.

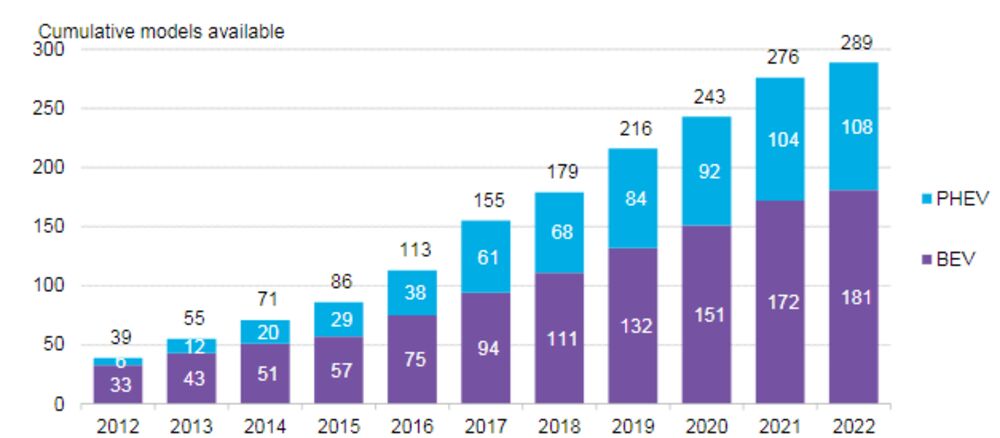

In total, the number of plug-in hybrid and battery vehicles for sale worldwide will rise 20 percent to 216 next year, according to Bloomberg NEF research.

Total Numbers of Electric Models for Sale

Bloomberg NEF

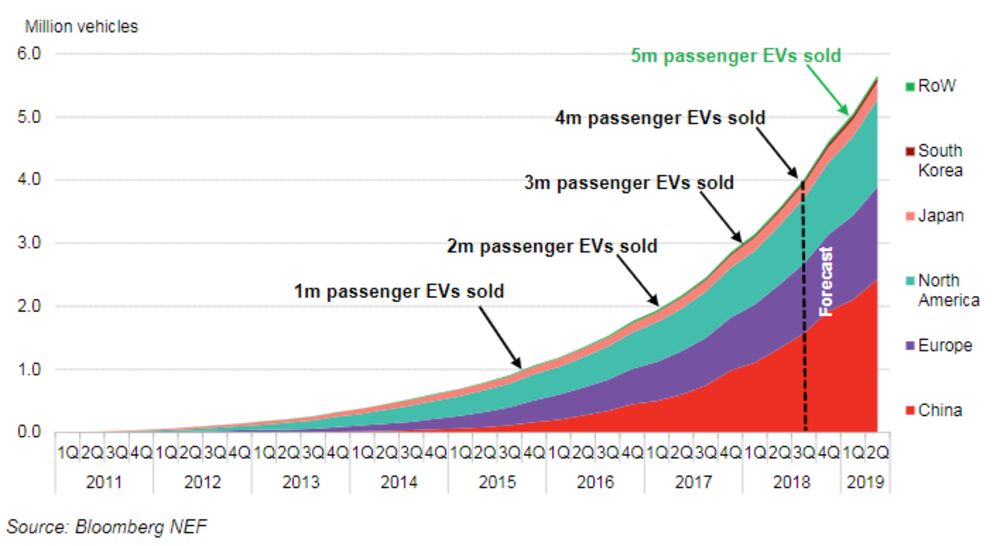

While electric and plug-in hybrid vehicles are still a tiny fraction of global sales, growth rates have been spectacular. In the second quarter, deliveries increased by 77 percent year-on-year to 411,000 vehicles worldwide, according to Bloomberg NEF. Even before the latest rally in oil prices, that was forecast to rise a further 49 percent by the same quarter next year.

“We’re already seeing demand outstripping supply,” said Fiona Howarth, CEO of Octopus Electric Vehicles, a British car-leasing firm. High oil prices “will add to the acceleration of growth. EVs are coming quicker than most people think.”

Cumulative Global Sales of Electric Cars

Bloomberg NEF

Crude oil has jumped 27 percent this year to more than $85 a barrel and major traders predict prices could reach $100 this winter as U.S. sanction of Iranian exports strain global supply. The rally has started to feed through to prices at the pump. In the U.S., average gasoline prices are on the verge of breaching $3 a gallon for the first time since 2014.

Bloomberg

The increasing ability of consumers to switch away from fossil-fuel powered vehicles will be a concern for the oil industry, from the giant integrated companies like Exxon Mobil Corp.and Royal Dutch Shell Plc, who sell billions of liters of fuel from global gas station networks, to policy makers in the Organization of Petroleum Exporting Countries. As drivers embrace electricity it will permanently demand for oil.

As well as new models, progress on the infrastructure needed to keep plug-in vehicles on the road will speed up in 2019.

Across Europe, utilities are pouring money into charging networks, anticipating the technology will catch on. Enel SpAin Italy, Vattenfall AB in the Nordic region and Centrica Plc in the U.K. all are building up systems to recharge car batteries even before it’s obvious how any of them can make money. China has an ambitious national program to build charging infrastructure.

“It’s a public service we have to provide. We don’t want to be a bottleneck for the development of the electric car,” said Ignacio Galan, chairman of Spain’s largest utility, Iberdrola SA.

A better charging network will help assuage the main consumer concern about buying an electric car: that a lack of range will leave drivers stranded by empty batteries they can’t charge up. “People are not going to buy electric vehicles if we don't get rid of range anxiety,” said Carlos Tavares, CEO of PSA Group, France’s largest carmaker.

— With assistance by Elisabeth Behrmann, and Reed Landberg

- Forums

- ASX - By Stock

- PLS

- re:Lithium demand surge

re:Lithium demand surge, page-25

-

- There are more pages in this discussion • 1,717 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add PLS (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

$2.64 |

Change

0.030(1.15%) |

Mkt cap ! $8.672B | |||

| Open | High | Low | Value | Volume |

| $2.61 | $2.67 | $2.59 | $25.06M | 9.511M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 31 | 58647 | $2.64 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $2.65 | 179206 | 18 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 5 | 295865 | 2.660 |

| 11 | 285796 | 2.650 |

| 7 | 195605 | 2.640 |

| 1 | 5000 | 2.630 |

| 5 | 167434 | 2.620 |

| Price($) | Vol. | No. |

|---|---|---|

| 2.670 | 2000 | 1 |

| 2.680 | 348102 | 3 |

| 2.690 | 2112 | 3 |

| 2.700 | 202804 | 12 |

| 2.710 | 64522 | 10 |

| Last trade - 11.40am 25/11/2024 (20 minute delay) ? |

Featured News

| PLS (ASX) Chart |

The Watchlist

ACW

ACTINOGEN MEDICAL LIMITED

Andy Udell, CCO

Andy Udell

CCO

SPONSORED BY The Market Online