Goldilocks?

Inconceivable!

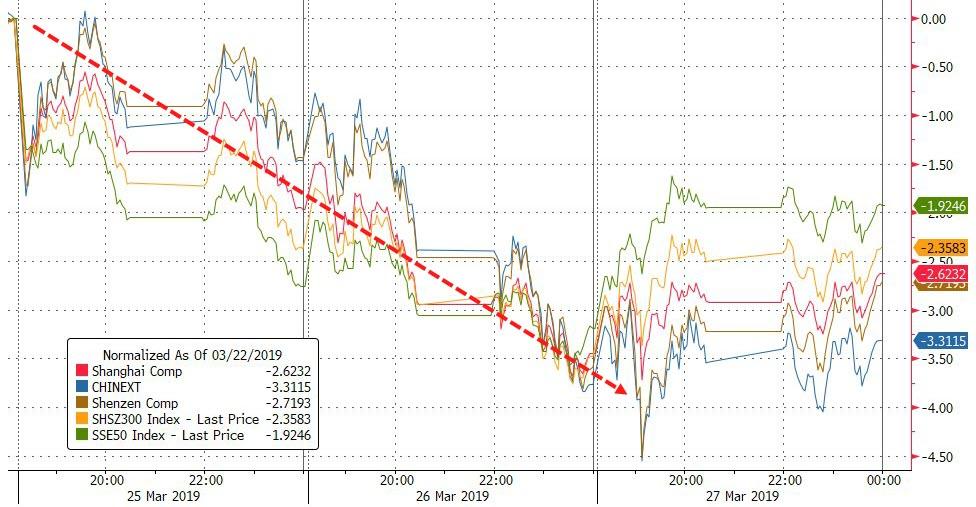

After two ugly days, China stabilized last night

European markets were volatile today but UK's FTSE continues to underperform as various Brexit deadlines loom...

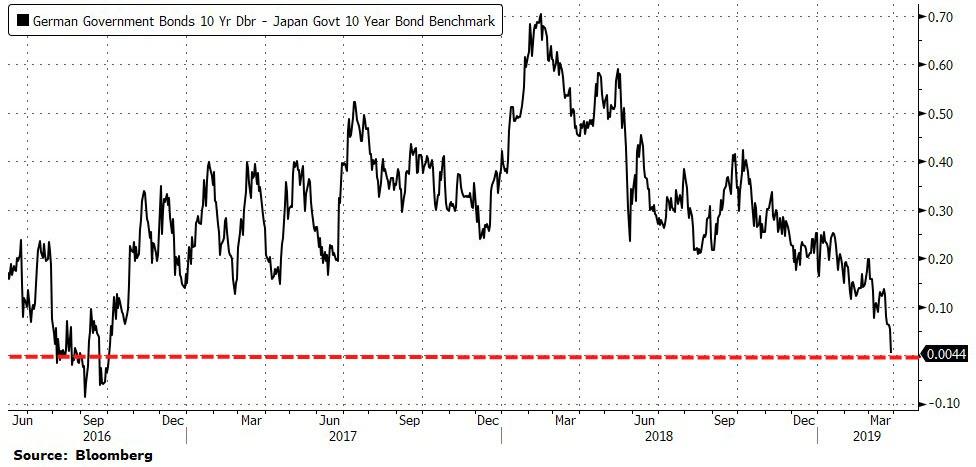

Meanwhile, German bund yields dropped back below JGB 10Y yields for the first time since 2016...

US markets tumbled shortly after the ubiquitous opening ramp, but reversed the downswing at the EU close. Nasdaq was the laggard today... (Dow was ramped to unchanged but all markets faded into the close)

S&P battled with 2800 all day...

Banks and Big Tech were both lower on the day...

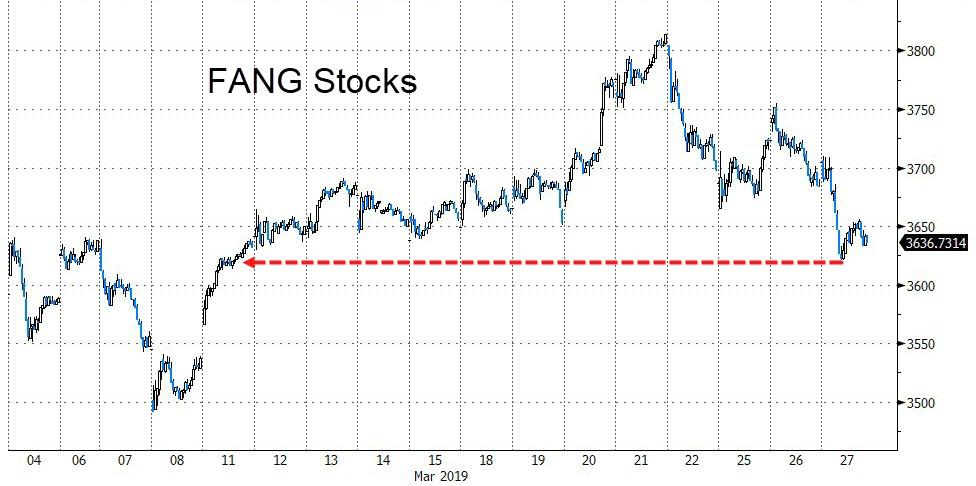

With FANG stocks ugly...

Semis closed at 10-day lows.

If the yield curve is right, banks have a lot further to fall...

Before we leave stock-land, let's take a peak at Brazil which topped 100,000 for the first time ever and has plunged over 7% since...

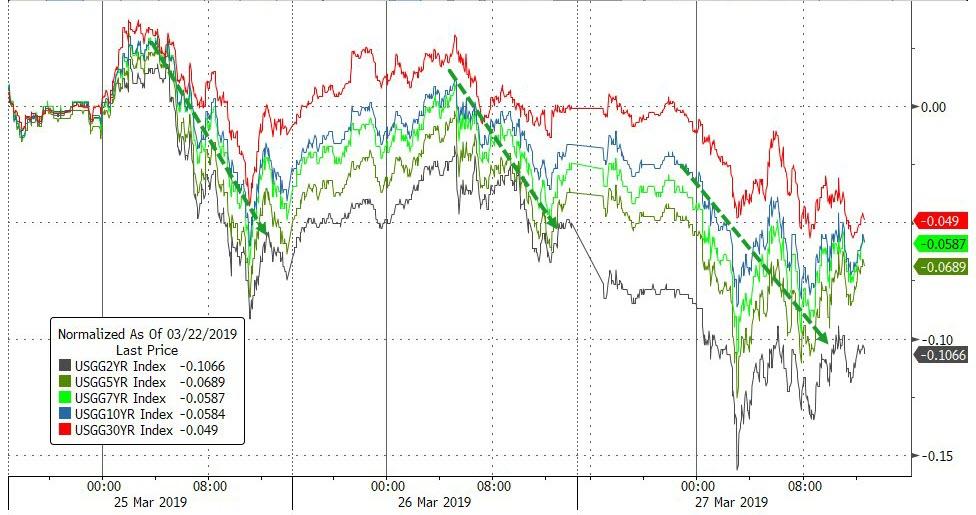

Treasury yields continued to tumble (down 4-5bps across the curve today)...

10Y tumbled to its lowest close since Dec 2017...

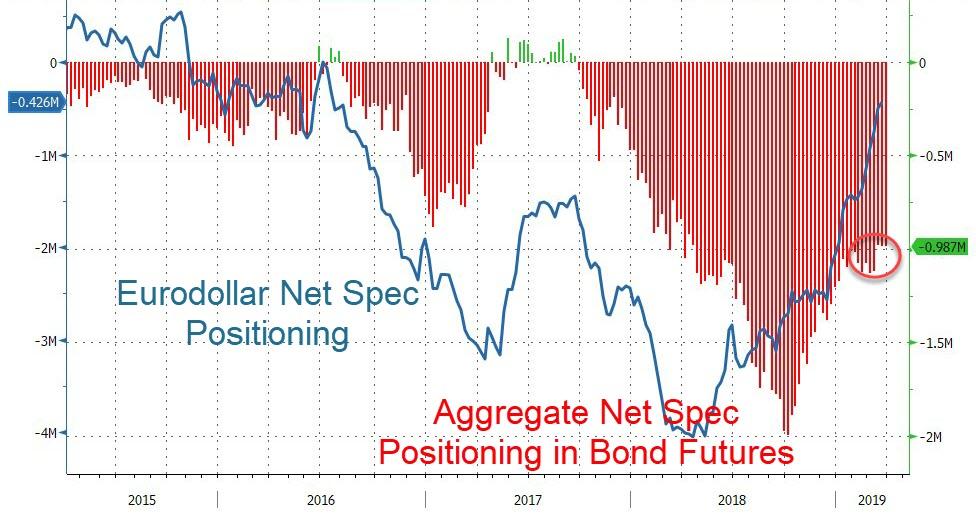

And arguably there is a lot more bond shorts to squeeze before this run is over...

Pick your point on the yield curve and it's inverting (or inverting further). Here is the 3m-18m T-Bill curve (shown - in Fed papers - to have highest tracking for future Fed path)...

The Dollar rallied for the second day in a row but failed twice to break the 97.00 level...

Cable trod water around 1.32 for the 3rd day in a row until May resignation and BoJo flip-flop headlines sparked a late rally...

EM FX plunged today - its been a wild ride recently...

Cryptos rallied on the day with Bitcoin Cash leading the way...

Weakness across all commodities today even as the dollar only managed modest gains...

Some 'fiduciary' decided that 0945ET was the exactly right time to dump just under a billion dollars of paper gold...

But Gold futures found support at their 200DMA

Silver broke below its 100DMA and found support at its 50DMA.

Permian natgas prices plummeted to record lows after a pipeline failure...

Finally, and burying the lead, after Moore's sycophantic op-ed, the market is now pricing in over 40bps of Fed rate-cuts in 2019 - dramatically more dovish than The ECB...

As Fed credibility is well and truly buried - so what is keeping this chasm alive?

- Forums

- ASX - By Stock

- Powell 'Throws In The Towel' On Growth & Inflation, Sees No More Rate-Hikes In 2019

Goldilocks?Inconceivable!After two ugly days, China stabilized...

-

-

- There are more pages in this discussion • 1 more message in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add ARD (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

2.5¢ |

Change

0.001(4.17%) |

Mkt cap ! $25.26M | |||

| Open | High | Low | Value | Volume |

| 2.3¢ | 2.5¢ | 2.2¢ | $114.3K | 4.950M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 3 | 345000 | 2.4¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 2.5¢ | 1492102 | 4 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 4 | 1346600 | 0.013 |

| 3 | 900254 | 0.012 |

| 5 | 5562933 | 0.011 |

| 2 | 550000 | 0.010 |

| 1 | 500000 | 0.009 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.014 | 867091 | 1 |

| 0.015 | 1101911 | 3 |

| 0.016 | 200000 | 1 |

| 0.017 | 464733 | 2 |

| 0.018 | 187500 | 1 |

| Last trade - 16.10pm 18/11/2024 (20 minute delay) ? |

Featured News

| ARD (ASX) Chart |