Today a legend who is connected in China at the highest levels predicted the price of gold is going to surge well above $2,000.

Trade War FalloutBy John Ing, Maison Placements

February 20 (King World News) – A slowdown due in part to the fall-out from the trade war between the world’s two largest economies, China and the US, suggests considerable cause for concern. Chinese statistics in the last few months have come below expectations. In the US, inflation is running about two percent but wage increases and the inflationary impact of tariffs have yet to surface. Retail sales fell to the lowest rate since 2003. Apple’s misfortunes are due to slowing iPhone sales in China. Industrial bellwether Caterpillar, expects sales to be flat this year after a whopping 40 percent increase last year. Harley Davidson blamed the tariffs for wiping out all of last year’s profits. China’s champion Alibaba, too warned about slowing growth and weakening sales. Midwest farmers’ bankruptcies are at the highest level in a decade. Unilateralism is not a fix at all. It will be costlier and less stable.

Business attitudes too have changed in a relationship that will outlast Trump’s presidency. In the last 50 years, America was on the ascendance but in the past two decades, its commerce and financial system became intertwined such that US laws today have extraterritorial reach against countries and companies worldwide. And now with the extradition arrest of Ms. Meng Wanzhou, Huawei’s chief financial officer in Vancouver and American indictments against Huawei, Trump’s administration’s intertwining of legal with commercial interests has changed the rules of engagement, likely for generations to come.

US, China and the Thucydides TrapAll of this suggests that the overriding aim of the US administration is to contain its strategic rival to maintain America’s economic and military primacy. China in turn has countered that it does not seek to impose Chinese culture on the world nor replace America’s hegemonic powers but desires a harmonious relationship over time.

Ambition is not lacking. For some time we have been concerned about the historical warnings of the Thucydides Trap, coined by Harvard history Professor Graham Allison, who noted that over the past 500 years there has been 16 instances when a rising power threatened to displace the incumbent power. Today, with Mr. Trump throwing down the gauntlet, triggering a trade war which has morphed into a tech war against the incumbent China, Professor Allison reminds us that in 12 of those 16 cases, they ended in war. And today the economic and financial interests are working against each other, with the trade hostilities, the first volley…

Meantime, with a likely extension of the self-imposed trade deadline, stock prices rallied on hopes of a positive outcome or at least a framework memorandum of understanding agreement. Nonetheless, the outcome is likely to be protracted because of thornier “structural” issues. Yet, both superpowers are in an uncompromising mood, having backed themselves into a corner. Mr. Trump is battling a resurgent Democrat party that controls the House and was locked in the longest ever government shutdown. Mr. Xi on the other hand is trying to blunt the affects of the trade war, maintain state control and a slowdown in the economy. Both are reluctant to lose “face”, yet need an agreement for political reasons.

In fact, the trade war has already enacted a huge cost on both sides such that there is a growing economic necessity to come to some agreement. Despite Mr. Trump’s main goal of reducing the trade deficit with China, China’s annual trade surplus hit a record $323 billion last year as US imports dropped sharply. Latest November data showed the US trade deficit with China fell $2.8 billion to $35.4 billion but the cost was borne by America’s businesses, consumers, and farmers in multiples of billions. While Mr. Trump gloated that China’s economy “slowed” to the lowest in three decades, at 6.6 percent it is still double the IMF’s estimated global economy’s rate this year and triple that of the United States.

China vs USTo become more self-reliant, China is using both fiscal and monetary policies, initiating stimulus on multiple fronts, to boost the slowing economy and kickstart its formidable consumer bloc. Beijing’s state-owned China Railway Corporation for example plans to build a total of 6,800 kms of new track as part of China’s infrastructure spending. China will expand its high speed rail network by 3,200 km this year. Still, trade, cross border investment and supply chains have changed, maybe for generations to come. And, China no longer the workshop for the world has become its locomotive…

Western headlines are full of fear mongering over China’s debt problems, the collapse of its shadow banking system and the risk of a hard landing. However, unlike the US, China’s government is reining in debt and cleaning up its financial ecosystem. Like the Fed, China’s financial system is underpinned by its central bank, the People’s Bank of China and similarly, China’s monetary policy uses multiple methods to control money supply and interest rates. Yet there are differences.

China’s banks are state-owned and bank debts for example are obligations of the state and covered by the central bank. Following the 2008 -2009 financial crash, the United States bailed out its publicly owned banks, but those government bailouts required billions of state aid and legislative approval. While China’s shadow banking systems’ debt load has grown exponentially to an estimated $10 trillion, China’s recent pre-emptive crackdown has quelled concerns of a premature bubble burst. We believe that rather be concerned over the world’s biggest creditors’ debt, we should be more concerned about the debt of the biggest debtor, the United States.

Going It Alone Has Its CostsThen there is businessman Trump’s spendthrift ways. What Mr. Trump most promised to advance, he has most set back, which has resulted in the racking up of billions of debt, widening the budget deficit to $1 trillion for the first time ever, made worse by a record $22 trillion debt load excluding spending on medicare and social security. The trillion-dollar deficit occurred because of an 18 percent increase in spending to $4.407 trillion, higher than $3.422 trillion of revenues, forcing the Treasury to borrow more. In response, the Treasury’s total new issuance last year amounted to $1.34 trillion, more than double 2017. Yet he still spends more. The interest rate bill alone matches his defense spending budget and the economy is already burdened by elevated debt levels.

Is this the year that America’s financial hegemony falls apart as part of the Trumpian retreat from the world stage? Protectionist threats still abound. One lies in the overreach of US financial hegemony and the extraterritorial usage of sanctions on Iran, Venezuela and Russia combined with the America-led SWIFT payment system to exert control. A second danger is that the “America First” push portends deeper problems for America’s economic model. In bringing back its supply chains to boost local employment, trade will become more regionalized. Ultimately, following the trade tensions between China and America, global commerce will split into separate trading and regulatory blocs. Regionalism will be “in”.

A bigger problem for America however is that in breaking down decades of alliances and changing the world order, it exposes its dependence and vulnerability on foreign investors, particularly since the pillars of the global financial system are crumbling as rising interest rates underscores the vulnerability of America’s debt based financial ecosystem.

Herein lies the risk. All these points help explain that the United States has less room to maneuver. After a decade of easy money and racking up record debt, the Fed has performed a dovish u-turn from rate hikes and quantitative tightening, to postponing even balance sheet reductions. Despite the best of intentions and rhetoric, newly minted Fed Chair Jay Powell capitulated after only four rate hikes that had put downward pressure on the stock market. Yet after years of quantitative easing, the Fed’s $4 trillion balance sheet is part of the world’s biggest bubble in history, treasury debt. Noteworthy, the Fed’s pivot towards a premature easing cycle will make future rate hikes even more difficult. A lower dollar is likely as he has run out of options. The dollar in the past has been a safe haven in times of trouble. What if that source of trouble is the US itself?…

Pitfalls of Weaponizing the DollarThe crux of the matter is that in weaponizing America’s financial and economic hegemony, it portends deeper problems as America’s ever-widening deficits require surplus savings from abroad, because its saving rate is much too low due to the substitution of traditional savings with asset-based savings. Ominously, the US debt to GDP has already exceeded 100 percent and the steady increase is a danger signal, particularly when the next recession will require financing. These are the same deficits that Mr. Trump, the then campaigner, railed about, but as president, now initiates a devastating trade war which could cause the next Depression.

The danger is that in misunderstanding the deficits as a product of a low savings rate, he ignores the important role that foreigners have in funding the excesses of a savings-short economy. In dismantling globalization from the rest of the world, trade has collapsed and the same is also true for cross border capital flows into the United States. Since 2008, foreign ownership of US government debt has declined 35 percent to only 36 percent last year, according to treasury data. And, foreign selling of US Treasuries in December hit a record high at $77.4 billion. As such, more must be financed domestically and if not, then debt issuances are likely to go to the buyer of last resort – the Fed. Quantitative easing redux. All this rankles America’s creditors and with the recent stock market volatility as a result of the trade war, America’s Achilles Heel has been exposed. Mr. Trump will learn that he can’t have it both ways.

Trump’s Pyrrhic VictoryMr. Trump risks winning a pyrrhic victory with his trade war with China. While some of America’s debt is held by the public, China remains the world’s largest sovereign holder with a mountain of some trillion dollars of treasuries amassed from the export boom. Debt can only be settled in two ways; future taxes or currency devaluation. The problem is that deficits must be financed, if not by Americans, but by foreigners, or devaluation by the printing press. In recent years, the printing press has been working overtime and devaluation appears the only option. Ironically not even Democrats’ rookie star, Ms. Alexandria Ocasio-Cortez’s(AOC) recommendation of a 70 percent tax rate on personal income would close the financing gap. Instead of tax hikes, needed is a cutback in spending but election promises keep getting in the way and despite opting for spending, inflation is always the inevitable result.

For too long, America has gorged on debt with the servicing of that debt, in an era of higher interest rates becoming increasingly difficult, particularly since the average rollover period is less than four years. The problem is expected to become more acute this year as recent “bill to cover” ratios of treasury auctions have declined markedly with buyers staying on the sidelines.

Alternatives To The DollarFurthermore, America has weaponized the power it gets from possessing the world’s chief reserve currency, which allows it a monopoly to print currency to pay bills, fight wars or cut off others from using the dollar payment system. The American dominated SWIFT payment system allows transactions in bank accounts regulated by US or European financial institutions but is slowly being replaced with alternatives. France, Britain and Germany for example have set up a Special Purpose Vehicle (SPV) called INSTEX to circumvent US sanctions on Iran which will allow an alternative SWIFT-like payment channel enabling trade between Iranian and European companies, thwarting US sanctions. Russia and China too are pursuing alternative forms of payment to circumvent US/Iranian sanctions.

China has recently swapped oil for renminbis with Russia as it internationalizes its currency. Russia dumped their entire holdings of US treasuries last spring, Coincidently for the sixth straight month in a row, China has dumped more than half a billion of US Treasuries, to the lowest level since May 2017. That move alone pushed prices lower and yields higher. Again coincidently, Chinese acquisitions in the US fell a whopping 85 percent last year. Simply the appetite for US debt and assets is dwindling as foreign firms are discouraged from using America’s hegemonic capital markets.

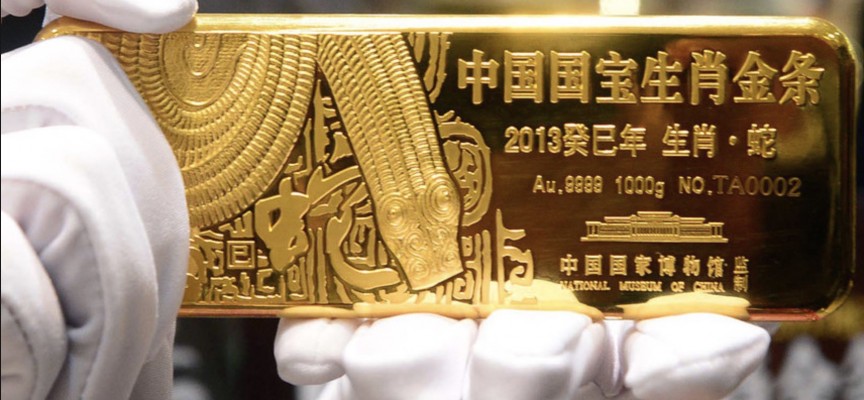

Although the dollar has become the world’s de facto reserve currency and keystone of the global financial ecosystem, Russia, China and Europe are challenging America’s financial and economic hegemony. “America First” to them is a warning. The world’s largest creditor, China has reserves of $3.1 trillion of which about a third consists of greenbacks. China added gold to its foreign reserves for the first time in more than two years in December, buying almost 12 tonnes in January to hold 1,864 tons, according to fresh central bank data. China also internationalized the renminbi, introducing swap features, and signing some 18 trade agreements. World-wide renminbi-based currency reserves are now on par with the Canadian dollar…

In The Beginning, There Was GoldFor some time we have warned investors about the US dilemma. The recent slippage of the greenback despite four rate increases is cause for concern. If the dollar weakens relative to other currencies, its use as a store of value or reserve will falter. The Fed as a buyer of last resort would find itself having to buy dollars with a bloated balance sheet already representing 20 percent of America’s GDP. Undermining the dollar, is investors’ fear that the trade wars, and an isolationist superpower strategy will slow global economic growth. Noteworthy is that the share of dollar denominated reserves reached a five-year low of 61.9 percent, according to the International Monetary Fund. And now that the sugar high from the tax cut has faded, investors and owners of dollars are looking for safer alternatives, spurring the demand for gold.

In fact, according to the World Gold Council, the world’s biggest central banks have been the biggest buyer of gold boosting their holdings some 74 percent last year and, buying the most gold in 50 years. So far, the central banks from China, Russia, Turkey, and Japan bought gold with their dollars reducing their reliance on the greenback. Russia has purchased almost a third of world supplies last year becoming the world’s fifth largest holder after the US, Germany, France and Italy, China is the sixth largest holder. To be sure gold’s primary role here is as an alternative to the dollar. As such last year, gold has outperformed the major stock markets and currencies (except for the Japanese yen). Gold backed ETFs are at the highest levels in five years as are central bank holdings.

Risk-Free Dollars Are No longer Risk-FreeWe believe that Mr. Trump’s self-inflicted wounds have hurt the US economy and his tariffs debacle has already become eerily similar to the Smoot-Hawley tariffs, which helped exacerbate the Great Depression in the Dirty Thirties. The world can ill afford a trade or another cold war between the world’s two largest economics. However, the cost is getting higher and America’s deteriorating balance sheet has become a question mark.

But this is not all about tariffs. The truth is that the United States faces even more red ink and now that the baby boomers are retiring with America’s house not in order, the laws of physics have not been suspended. We believe that the age-old discipline of supply and demand will leave the US dollar with only one way to go, down. For now, risk free dollars are no longer riskless.

There was a time when gold was money. In today’s uncertain world, the under-owned yellow metal is back in fashion not as money, but as its traditional role as a safe haven when everything else seems so risky, particularly when the US dollar looks so vulnerable.

We believe that gold’s bull market is only just beginning with its upside momentum firmly established above $1,300. What damages trust in the US, damages the whole world. While the US financial system is in shambles, gold is an effective hedge against financial and economic crises. Already awash in dollars, central banks are looking for alternatives, accumulating gold instead. Gold is not only an alternative investment to the dollar for these central banks, but sanction-proof.

That said, we believe gold will continue to rise in value as long as America’s twin deficits keeps growing. Our proprietary momentum system flashed a technical buy signal for gold on a short, intermediate and long-term basis on December 21 last year. Gold reached a bottom at $1,150 last year but has jumped to a new range beyond $1,300, a level not seen since June last year spurred by central bank and investor buying. In fact, there can no longer be a stronger endorsement for higher gold prices when insiders such as the central banks buy the most gold in 50 years or the senior gold players buy each other. Consequently, without a radical change in US financial policy, we continue to expect gold to hit $2,200 within 18 months.