Lots of risk but lots of Reward for first movers in CVS. Gold is going to be important in the future for small investors so a chance to get in early and cheap in CVS.

Gold will always beat crappy currency countries in the long run. Just the thought about developing Paynes Find Gold makes me excited. The old gold miners never fully developed the Paynes Find Gold fields at all and there are for sure a lot of opportunities for CVS to partner or go it alone with the potential and recorded mineral sites. Management of CVS and the old Delecta Management knows and knew about the recorded sites years ago and have posted extensive information on the fields.

That is why the t.sage scooped up the 25 million shares of CVS to make the deal. That is all facts folks but you can say all in my opinion anytime.

I GOT GOOD OPINIONS LIKE MY OPINION ON EUR!

But read the excellent article below for fun and excitement..................

The gold market in 2018

Published 16th January 2018

Categories:

Market insights,

Demand,

Investment

Download (pdf, 175.95 KB)

In 2017, investors added gold to their portfolios as incomes increased, uncertainty loomed, and gold’s positive price momentum continued. As 2018 begins we explore four key market trends and their implications for gold:

- synchronised economic growth

- shrinking central bank balance sheets and rising rates

- frothy asset prices

- market transparency, efficiency, and access.

We believe that these trends will support demand and maintain gold’s relevance as a strategic asset.

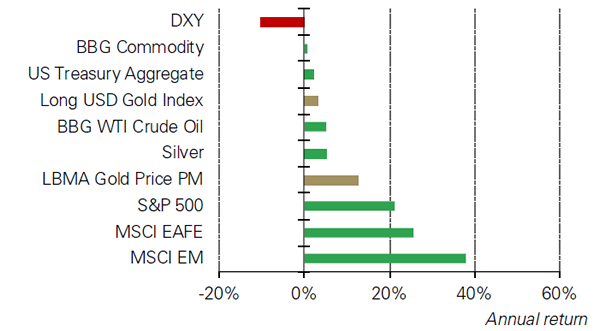

Chart 1: Gold outperformed major asset classes in 2017*