Below is the Google translated version of above article

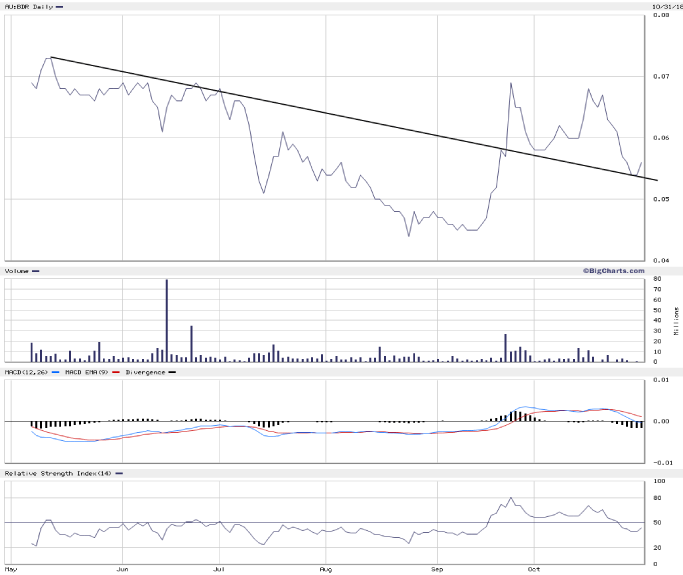

Beadell Resources Ltd .: Quarterly figures show positive development

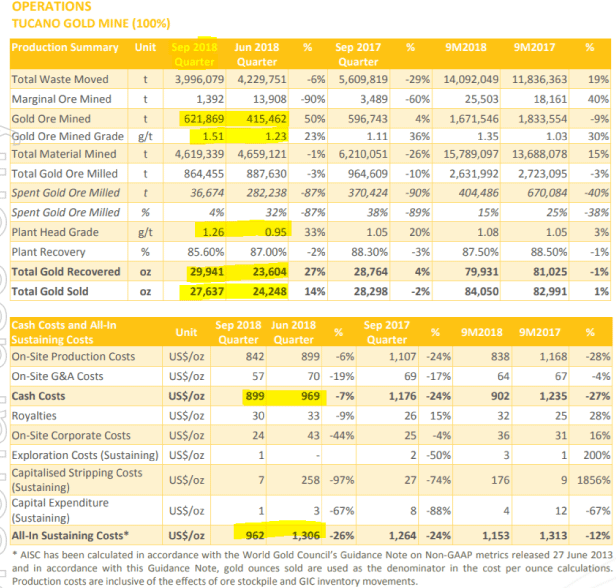

Gold producer Beadell presented today the quarterly figures at the end of September ( Link ). It was a good quarter, better than I expected. The company produced 29,941 ounces of gold during the quarter, 27% more than in the last quarter. 27,367 ounces of gold were sold, 14% more than in the previous quarter. Cash per ounce dropped 7% from $ 969 to $ 899, and all-in from $ 1,306 to $ 962, a whopping 26%. The average revenue rose significantly, which immediately impacted on the costs. The new Brazilian contractor has started work and has taken over the helm 95% of the time. The new equipment was brought to the mine and Beadell Resources assumes that this change will be completed in November.

The forecast for the calendar year 2018 has been confirmed. It is expected to produce 125,000 - 135,000 ounces of gold at the all-in cost of $ 1,000- $ 1,100 by the end of December. For the first 9 months, Beadell has now produced 79,931 ounces at an all-in cost of $ 1,153.

If the plans are respected, then Beadell would have to produce 45,000-55,000 ounces in the current quarter, which would be a massive jump in production.

Beadell repaid some of its debt in the quarter just ended : MACA was valued at $ 6.3 million, Santander scheduled to receive $ 2.5 million and an additional $ 1.3 million to reduce the line of credit.

Conclusion :

A nice development for Beadell. The contents are rising, production has increased and costs have been reduced. The company is on the right track, which underscores these quarterly figures.

© Hannes Huster

Source: Excerpt from the stock market letter " Der Goldreport "

Mandatory disclosures pursuant to section 34b WpHG and FinAnV

The main sources of information for the preparation of this document are publications in domestic and foreign media (information services, business press, trade press, published statistics, rating agencies and publications of the analyzed Issuers and internal findings of the analyzed issuer).

At present, the following conflicts of interest are possible: Hannes Huster and / or Der Goldreport ltd. affiliated companies:

1) have business relations with the issuer.

2) are or may be part of the issuer's share capital.

3) were involved in the management of a consortium that issued issuer financial instruments by way of a public offering within the previous twelve months.

4) manage the issuer's financial instruments in a market by placing buy or sell orders.

5) have entered into an agreement on investment banking services or receive performance or performance from such arrangement within the preceding 12 months with issuers that are themselves or their financial instruments subject to the financial analysis.

Note Editor: Mr. Huster is speaker at this year's International Precious Metals and Raw Materials Fair , which takes place in Munich on November 9th & 10th, 2018.