Regal are a hedge fund and have a long track record in engaging in this sort of market behaviour. However, significantly IMO they are selling the shares that they got at 14/15 c including the placement before last at 14c (not the recent one at 28c). They certainly aren’t selling at a loss!

However as Bill observed, their actions have had tragic consequences for the AML SP which has been crunched by Regal’s huge selling volume. If you have a hedge fund on the register you have to expect this type of behaviour IMO. So questions need to be asked about giving a hedge fund so many shares in a placement?

Management reported that the shares went to institutions and patient long term investors. Seriously?

Unfortunately, once again this relates to a serious error of judgement by AML management IMO. As I understand it, despite strong advice to the contrary, they gave and continue to give Regal placement shares. So, therefore, diametrically opposite to management’s claim that the shares were placed with patient long term investors, large amounts have been given to Regal with the subsequent huge sell down hurting all shareholders.

While this again is not a good situation in the short-term, nothing has changed in the fundamentals of this being an excellent resource which is massively undervalued.

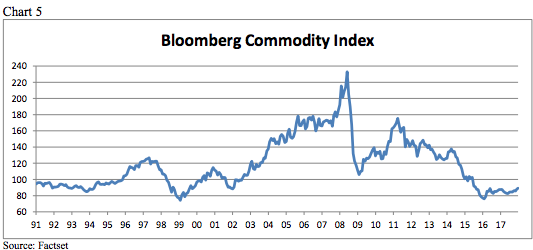

The news about cobalt and copper continues to be excellent. This chart from Bloomberg shows that commodities overall are only just starting to recover with still a long way to go yet:

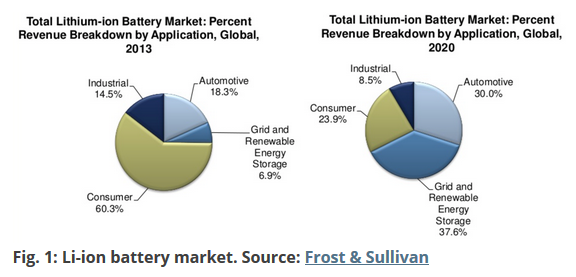

This chart predicts that home storage batteries will be bigger than electric car battery usage by 2020:

This is currently getting a huge boost here in Australia with Elon Musk continuing to build good relationships with various Govt entities who look to be strongly embracing and encouraging energy storage batteries.

Plus there is ever increasing news about companies like Apple, BMW, VW etc. scrambling to try to secure long term, stable cobalt supplies (and preferably not from the Congo).

Whilst, mgmt. issues are extremely frustrating, unfortunate and unnecessary, there is a huge amount of blue sky ahead IMO…

- Forums

- ASX - By Stock

- AML

- Explanation of recent huge selling

Explanation of recent huge selling

-

- There are more pages in this discussion • 5 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add AML (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

0.5¢ |

Change

0.000(0.00%) |

Mkt cap ! $5.482M | |||

| Open | High | Low | Value | Volume |

| 0.0¢ | 0.0¢ | 0.0¢ | $0 | 0 |

Featured News

| AML (ASX) Chart |

Day chart unavailable