Here’s what Trevor Hoey of FinFeed had to say yesterday

(NRW was one of his three stocks. ..)

https://finfeed.com/trifecta/looking-for-diversification-heres-three-stocks-to-consider/

Looking for diversification? Here’s three stocks to consider

By Trevor Hoey. Published at Mar 5, 2019, in Trifecta

“NRW Holdings Ltd

NRW Holdings Ltd (ASX:NWH) is a good example of what happens when you get it right, and the company certainly fits the bill in terms of providing diversification as a provider of contract services to the resources and infrastructure sectors in Australia with extensive operations in Western Australia, South Australia, New South Wales, Queensland and Victoria.

NRW’s areas of expertise cover a wide range of areas including civil engineering, bulk earthworks, concrete installation, contract mining and drill and blast.

Another point of difference is the group’s design capability, as it offers original equipment manufacturing of innovative materials handling products, complemented by a division that handles the refurbishment and rebuilding of heavy duty equipment.

The group generated EBITDA of $74.3 million from revenues of $521 million in the first half of fiscal 2019.

This represented underlying earnings growth of nearly 90% compared with the previous corresponding period.

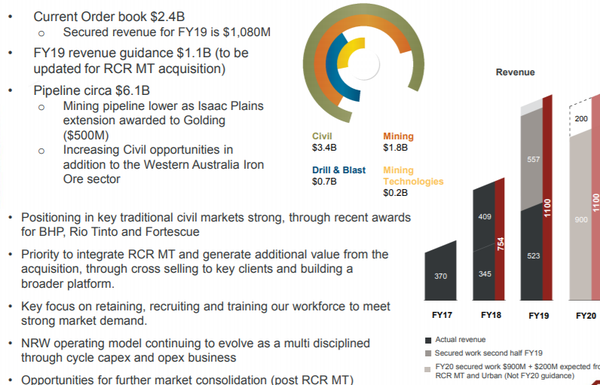

Orders received during the six month period totalled approximately $1 billion, increasing work in hand to $2.4 billion.

In relative terms, the company finished the half year with minimal debt and cash of $82.7 million, up from $58.8 million as at June 30, 2018.

Capacity for further acquisitions

NRW has demonstrated a thirst for acquisitions in the past, and given the robust nature of its balance sheet management could use this as a strategy to harness growth.

Setting aside acquisitions, developers of large mining or civil infrastructure projects generally favour companies with strong management, robust financials and a demonstrated track record of delivering on expectations.

NRW has proven itself on all three counts.

While the company has the capacity for further growth, it is important to note that this impressive set of numbers has been building over a period of time as evidenced by the following three-year share price chart, demonstrating the company’s recovery from tough times following the GFC.

NRW continues to perform well.

Trading at discount to industry group average

NRW’s order book suggests that revenue predictability over the next few years his strong and on this note the company chief executive Jules Pemberton provided a little more detail in saying, “Following the Eliwana and Koodaideri contract awards we already have over $900 million of work secured for fiscal 2020 which currently excludes contributions from the Golding Urban and RCR MT (acquired in February 2019) businesses.

“These businesses have consistently delivered $200 million of revenue per annum in prior years.”

This suggests that Hartleys analyst, Trent Barnett may not be far off the mark with his fiscal 2020 projections. Of course that is speculative and time will tell.

Barnett is forecasting NRW to generate EBITDA of $156.1 million from group revenue of $1.34 billion, equating to earnings per share of 24.8 cents, which implies a PE multiple of 9.3 relative to the company’s current share price.

Given that the average PE multiple for the sector is 15.7, Hartleys’ 12 month price target of $2.61, implying share price upside of 13% appears achievable.

- Forums

- ASX - By Stock

- Bullish Sign? - Bounced off 200 EMA

Here’s what Trevor Hoey of FinFeed had to say yesterday:) (NRW...

-

- There are more pages in this discussion • 48 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add NWH (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

$3.89 |

Change

-0.010(0.26%) |

Mkt cap ! $1.574B | |||

| Open | High | Low | Value | Volume |

| $3.86 | $3.92 | $3.84 | $906.3K | 232.9K |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 9 | 10542 | $3.89 |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| $3.90 | 6560 | 22 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 1 | 5058 | 2.370 |

| 4 | 18795 | 2.360 |

| 4 | 37687 | 2.350 |

| 1 | 7879 | 2.340 |

| 3 | 24992 | 2.330 |

| Price($) | Vol. | No. |

|---|---|---|

| 2.390 | 11634 | 3 |

| 2.400 | 71958 | 7 |

| 2.410 | 16085 | 2 |

| 2.420 | 19941 | 3 |

| 2.460 | 816 | 1 |

| Last trade - 12.39pm 04/12/2024 (20 minute delay) ? |

Featured News

| NWH (ASX) Chart |