I am actually quite confused by your reply, given it is pretty clear from the thread I commented on that I was using EPS and P/E ratios to assess another posters calculations. At the time I was commenting on a post by @Michaeljob which used that methodology as well, and generally supported his conclusions.

Now, I recognise you have bought and sold into this stock and that is fine, because that is what I would expect in an exploration play. Note: I use the term exploration play here instead of production play deliberately btw. My intention is to undertake a free carry strategy btw - why detailed below.

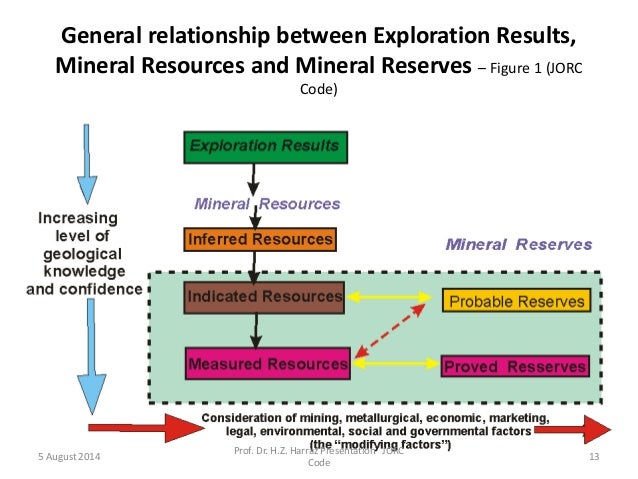

There is a reason why I say the above, if CZL had a JORC with significant resources in the Measured and Indicated Resource (not an Inferred Resource as Inferred Resources are not the basis of mining investment decisions btw) I actually would have used an Internal Rate of Return Model and actually mapped out capital spends with operating spends, thrown in tax rates etc etc to assess project viability. Infact I would have done the modelling in the manner I did it in my post in a recent post in AVZ if interested, and note in that modelling I don't deal with EPS or P/E, I seek to determine an IRR to see if the project is viable over a 20 years production life - refer Post #: 35711567 So if interested in what an IRR is as against the EPS scenario I did here suggest holders just guage what I did in AVZ recently, if interested. If seeking funds from bankers for capex funding they are interested in IRR as against EPS, as you would know.

Obviously with CZL, an IRR model is a waste of time as it doesn't have the resources yet to sustain a 10 year plus life to warrant such an assessment, infact its mine life if it cannot increase the measured and indicated category would not sustain operation for more than 3 years in the now IMO, but been in production on prospective ground gives confidence more resources in those categories will be found with further exploration. That is why I refer to CZL as an exploration play, but much better off than your typical exploration plays because it can fund its own exploration going forward through the small scale production it is now doing in the now. I would be hoping with further exploration they can identify further resources to significantly increase the production rate going forward and sustaining that for more then 10 years (making it a typical miner, and it is not a typical miner in the now).

Now looking at this Ann, it is clear they are acquiring an asset, but whether they maximise the value of that asset acquisition for SH is dependent on finding more resource, and in particular moving a resource into the measured and indicated category, because the only resources that matter in a bankable study/PFS are those in this category as these are then assessed against other technical and economic parameters to move them into the proven and probable reserve category that mining investment decisions are based upon. Here is pic of JORC for others to understand these blabberings:

The most important comment in this Ann btw is actually IMO IMO is the following in italics below - page 2:

"The Company’s main focus is to identify and explore new zones of mineralisation within and adjacent to the known mineralisation at Plomosas with a view to identifying new mineral resources that are exploitable."

Now, the reason for me focusing on EPS is also to determine scope for additional internally funded exploration, and it would appear to me that the money they will raise from the mine in production - albeit a short mine life - will IMO fund their exploration program going forward. This current Ann is predominantly about finalising the acquisition, so there lies the risks to SH - the maximisation of profits under the acquisition will occur if find additional resources that can be exploited to extend mine life. The EPS is only an indicator on long term SP if there are resources to sustain long term activity, an obvious point.

Whilst the company is in production now, it doesn't have a resource for a long life mine and therefore needs to find more resources. As I said, the EPS it derives will drive that exploration spend IMO. To holders don't expect the EPS to mean a dividend stream, it means exploration spend IMO (and most likley no additional dillution as I suspect can fund exploration going forward from it margin (see below).

Now over the next 12 months holders here will have ample opportunities to free carry IMO IMO, a strategy one might want to consider here given the risks here is exploration could fail hence the acquisition might not yield the rewards one thinks as a SH. That is the risk reward equation here, but at least doing some mining now is a good thing especially if it can fund your future exploration (meaning much less dilution to capital raise). As I said this Ann is about completing an aquisition so this CR was unavoidable.

@sodge, the reworked calcs, noting the above are below - because the increase in shares is 6.3% doesn't do much to previous calcs btw as now calculating based on some 987 million shares, instead of the previous 924 million shares:

All IMO and time for a VB and another.

GLTAH and as I said consider your risk reward equation and whether free carry is a strategy for you. I certainly intend using a free carry strategy btw, but that is me and all IMO IMO IMO

- Forums

- ASX - By Stock

- Ann: Share Purchase Plan

I am actually quite confused by your reply, given it is pretty...

-

- There are more pages in this discussion • 45 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add CZL (ASX) to my watchlist

Currently unlisted public company.

The Watchlist

ACW

ACTINOGEN MEDICAL LIMITED

Andy Udell, CCO

Andy Udell

CCO

SPONSORED BY The Market Online