1) A stabilising macro oil price.

Keywords:

Stabilising - yes between a likely trading range of $40- $50 into 2017 by what I read

Macro - effects most of the industry but will vary. Those that produce large quantities get the most benefit.

Overall good for everyone if and when it occurs and its effect on individual stock prices is highly variable. Look for best in breed (see closing picture)

2) Possibility of a reduction in OPEC + Russia oil production rates.

Keywords:

Possibility - may or may not happen. Rhetoric was on a "freeze" which is not a cut

Reduction - who said reduce? SA & Russia say a freeze maybe but not necessarily now and KSA say maintain market share (i.e. not increase). Iraq, Iran, Libya, Nigeria want to get back to their highs too.

3) AKK is now a low cost oil producer with break even ability circa $45.

Keywords:

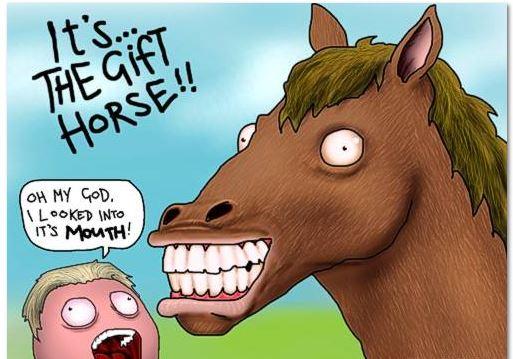

Low cost producer - this is just a statement. AKK public financials presently do not prove that (in fact they prove otherwise). Breakeven has not been broken out - there are many variants of this number. Which is AKK using. (remember - beware of Greeks bearing gifts)

4) Two of three wells drilled with final well drill news due in two to three weeks.

Keywords:

News due - True. Whether positive or negative who knows. There is always "news due"

5) Impending flow testing news announcements.

Keywords:

Impending - good word meaning imminent, forthcoming, looking large, menacing, threatening. A good way to describe the flow testing. I posted earlier (statistical) probabilities of combinations of wells meeting P10/P50/P90 type EURs and a chart that shows cumulative production that matches the P50 decline based on estimate EUR slightly above the P50. Watch for IP24hr of course and the follow up for IP30day and IP90 day (yes its a long wait) given the 10 year picture being painted ....

6) Strengthening technical's and liquidity within AKK's SP.

Keywords:

Strengthening - really. OK if you say so.

Referenced picture

Good luck.