re: Ann: GRK: Lawford 1 in Canning hydrocarbo... Hi Gasbag

I am not sure if we will be able to find any people who want to exit from NSE around mid 20s. Some people waiting to buy at higher levels.

This is not a LT play. I disagree with that. First of all we are starting to deepening Lawford-1 well next month. That is going to be very exciting. Then NSE will announce their actions for Merlinleigh in next 3 months. I mean there are a lot to do. If you want to have a position in these events you need to get your shares now!

Also, anything can happen with any shale gas play in any time in Australia now. Because CSG business is in big danger atm, majors should be looking to back up their gas by some shale gas plays in Cooper Basin and Canning Basin (Only NSE is there).

However there are not many shale plays to be played with in Australia. The biggest possible shale gas play tenements are held by NSE in Canning Basin.

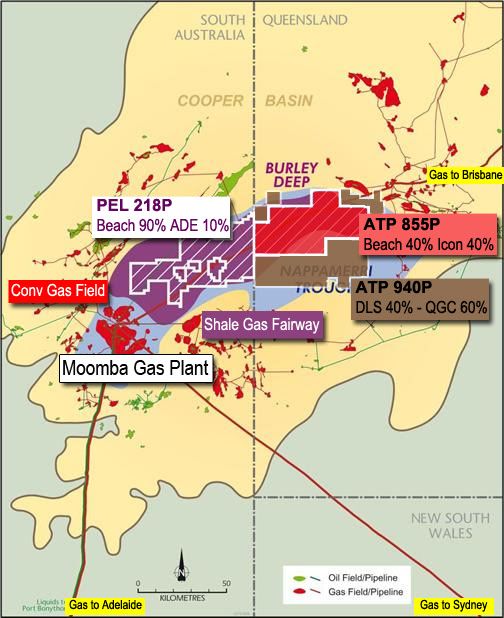

In Cooper Basin, there is a small shale gas fairway on three tenements. BPT (Beach Energy) holds the biggest part of it. It holds 90% of EP-218 and 40% of ATP-855. The other

tenements is held by Drillsearch 40% and BG Group 60%. Beach Energy is a great company but it is expensive to be taken over. It has already booked 2 TCF gas, but no one cares about the value of that gas. That is a big stupidity for those majors.

Therefore, Conoco now makes the smartest move onto NSE here, and trying to secure the possible future gas fields.

So anything can happen any time. I am expecting big moves towards the shale gas explorers. NSE is at the top of the list.

This week, Shell and Total have separately made gas supply agreements with South Korea, 18 years and 26 years respectively over 3.5mt gas per year. Gas will be supplied form Australian gas fields! Not from Arabian fields. This gas business is going to get bigger and bigger.

- Forums

- ASX - By Stock

- Ann: Lawford 1 in Canning hydrocarbon play to be

-

- There are more pages in this discussion • 7 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)