Demand Soars as ASX Junior Picks Up Prospective Austrian Cobalt & Gold Projects

PUBLISHED: 13-03-2018

The trend towards buying electric vehicles (EVs) over traditional vehicles has been slow to take off with Australian consumers, but elsewhere it’s a different story.

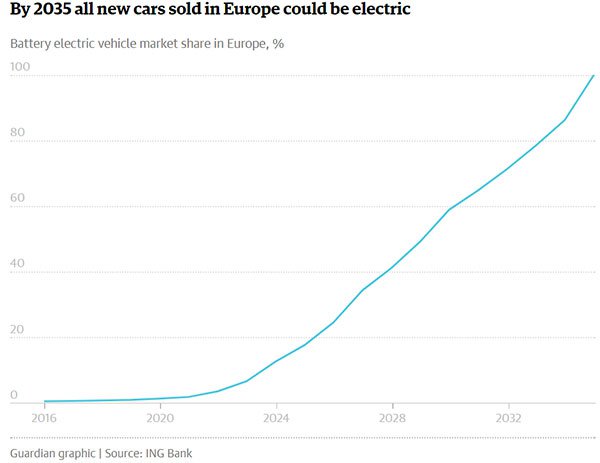

In Europe, it’s estimated that by 2035 all new cars sold will be electric powered, with Swedish firm Volvo recently declaring that it would only launch hybrid, plug-in hybrid or 100% electric cars from 2019.

Beijing is going a step further with plans to have no combustion engines in new cars by as early as 2030 — just over a decade from now. China already has the highest number of EVs on the road, with drivers offered the choice of 75 different EV models.

Much has been made of Tesla’s influence, although Tesla is far from alone in betting on the EV market. Traditional car manufacturers the likes of Ford, Nissan, Toyota and Honda are rapidly advancing their own EV vehicles.

In short, electric vehicles are the way of the future, although that hinges on manufacturers being able to source adequate battery materials — namely lithium and cobalt, plus copper, and other new energy metals.

Cobalt, once just a by-product of nickel and copper mining, is fast becoming one of the core ingredients of our technology-driven lifestyles, yet current cobalt supply is failing to meet demand, and that’s before the 500% increase in demand that’s expected by 2020.

Today’s cobalt junior has just acquired nine compelling projects in mining friendly EU jurisdiction, Austria, which is sandwiched between car manufacturing giants Germany and Slovakia and hopes to meet the growing demand in quick time.

This suite of attractive exploration and development assets includes an advanced portfolio of brownfield cobalt/copper and gold assets, and its highly prospective Exploration Permits include high-grade cobalt, copper and nickel, and gold and silver.

It is, however, early days for this stock, so investors should seek professional financial advice if considering this stock for their portfolio.

Being situated in Austria is extremely valuable to any cobalt junior with an eye to commercial production. Its location close to manufacturing plants is one of the advantages. Another is that Austria is a mining friendly jurisdiction, a major factor for cobalt end users.

Currently, upwards of 60% of all cobalt comes from the Democratic Republic of Congo (DRC). However, new sources are urgently sought as the DRC’s cobalt industry is plagued by human rights violations as well as being at risk of political instability.

The pressure is increasing on major manufacturers to find alternative cobalt supplies. Companies including Apple, Samsung, BM, Dell, and Tesla have already taken steps to improve their cobalt sourcing practices, while many are still to take action on the issue. This delay can at least be partially attributed to not having enough alternate cobalt sources available.

Today’s ASX junior has identified the opportunities on hand and as attention turns towards alternative cobalt markets, is shifting gears to capitalise on the promise of European cobalt discoveries.

Introducing…

High Grade Metals

ASX:HGM

High Grade Metals (ASX:HGM), formerly Quest Metals (ASX:QNL) has made the strategic decision to shift its focus from Western Australia’s goldfields to Europe, with an agreement to acquire Austrian Projects Corporation (APC) for A$5.4 million.

The deal delivers HGM 100% of APC’s Austrian Cobalt and Gold Projects. This is a portfolio of nine highly prospective Exploration Permits in Austria, including four cobalt projects covering 44 square kilometres, plus five gold projects over 170 square kilometres.

The Austrian Cobalt and Gold Projects are attractive exploration and development assets with tenements that include former high-grade cobalt, copper and nickel, and gold and silver mines and workings.

The deal involves HGM issuing 186 million ordinary shares in the company, 65 million options, and 240 million performance shares in exchange for 100% of APC and its projects.

HGM will also raise $4.5 million at 3.0 cents per share to fund exploration across its Austrian projects.

The completion of the transaction was the catalyst for Quest to be renamed ‘High Grade Metals Limited’ and it will now undertake a restructure of its board. Two new experienced directors will be appointed in Torey Marshall as Managing Director and CEO, and Hayden Locke as non-executive director.

Helped by the addition of Marshall and Locke, HGM is backed by a proven management team, focused on quickly advancing projects into production.

HGM will now carry out a two-year exploration program focusing on cobalt, nickel and copper at the Leogang and Seekar projects. It will also determine the high grade gold potential of the Schellgaden gold mine.

Investors were certainly impressed with the move, sending the former Quest’s share price higher immediately after the acquisition announcement. The stock rose from 3.2 cents before it entered a trading halt on October 30, to 5.5 cents after the announcement was made on November 14.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Now let’s look at HGM’s Austrian entry in more detail…

HGM acquires Austrian Projects Corporation

HGM’s Austrian Cobalt Projects comprise four exploration concessions — Gratlspitz, Schwarzleo, Seekar and Zinkwand — which are made up of 78 Exploration Permits, valid until 31 December 2021 and covering 44 square kilometres.

They are mapped out below:

The region has a long mining history that includes nickel and cobalt being mined from the mid-16th century. At that time Leogang was famed for the richness of its cobalt and nickel mineralisation.

The Leogang Project is a potentially valuable and strategic source of cobalt in the heart of Europe’s new battery manufacturing region. Historical exploration results at Leogang/Nockelberg have recorded samples of 1.95% to 15.76% cobalt, 1.29% to 12.7% copper, and 1.55% to 8.12% nickel.

Historical exploration also revealed high grade massive sulphide ores of up to 22% copper and 850 grams per tonne of silver reported in Seekar, while high grade mineralisation of up to 2.17% copper was reported at Gratlspitz.

Despite centuries of mining, the majority of the projects have not seen any modern exploration. That means the records on the area are not complete and significant new exploration activity is needed to properly investigate the overall size and scale of any mineralised body that was historically mined.

Yet, having been operational in the past, these areas generally have good access to roads, supporting infrastructure and to the people that needed to assess the tenements’ prospectivity via a systematic exploration program.

This historic information combined with more recent sampling, suggests strong grades and the right mineralisation for ease of processing.

One important fact to note is that the cobalt is in sulphide deposits which have lower capital and processing costs relative to nickel-cobalt laterite deposits, from which a large amount of the world’s cobalt is mined.

There’s a reason HGM has moved into cobalt at this time and in this location and it has to do with…

The rise of the cobalt market

Austria offers resource explorers all the benefits that come from operating in a mining friendly jurisdiction. This has particular relevance for cobalt miners and explorers.

The fact that the majority of all cobalt is currently sourced from the DRC is a major problem for cobalt buyers. Major manufacturers including Apple, Samsung, BM, Dell, and Tesla have outlined their steps to find alternative, ethically sourced cobalt, while other major companies are facing increasing pressure to do so.

One issue with this is that there are only limited alternate sources of cobalt available.

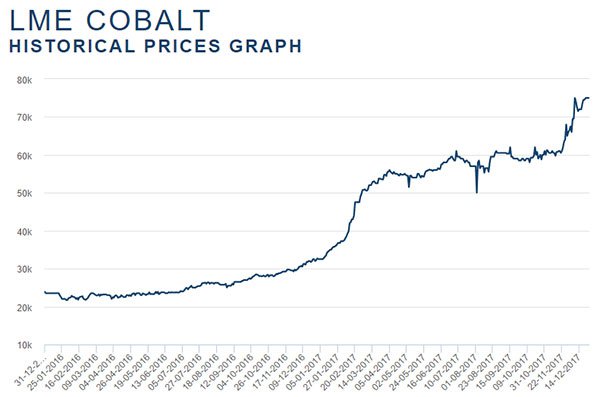

The near-insatiable demand for rechargeable batteries and their required cobalt, combined with supply issue saw the price of cobalt on the LME soarby 129% in 2017.

While currently priced at around US$81,500 per tonne, there is speculation that it has the potential to climb above US$100,000 per tonne. Here’s a two-year chart of the cobalt price (US$/t):

HGM has extensive and portfolio-wide potential to take advantage of significant forecast supply shortage in cobalt that is likely to drive prices substantially higher going forward.

As discussed, a big part of the cobalt drive will come from Europe.

Why HGM has pitched tent in Austria

HGM’s decision to acquire the Austrian Cobalt Projects is a well-considered move as Europe is emerging as a major producer of EVs and other battery powered technologies.

Also working in HGM’s favour is a recent proposal by the European Commission to cut greenhouse gas emissions which will facilitate the rise of clean technologies and in turn the need for the relevant minerals to power new technologies…

Slovakia produced over one million cars in 2016, that’s highest per capita rate of any country. The eastern European country is home to three car plants run by Peugeot, Kia, and the largest — Volkswagen. Add to that a fourth plant from Jaguar Land Rover which is due to fire up next year and you have an EV hub that could be the envy of the world.

Interestingly, Slovakia is just across the border from Austria, so HGM is well placed should it meet its exploration ambitions.

Here’s a look at the volume of production needed to meet future demand from both within Europe and beyond:

Of course, it’s not just Europe that is seeing surging demand for electric vehicles. As you can read about in the Forbes article below, demand in China is skyrocketing too…

This rapid shift away from combustion engines to rechargeable batteries hasn’t gone unnoticed by savvy resource explorers and is beginning to gain increased attention from investment markets too.

But it’s not only EVs that are fuelling the increased demand for cobalt. Cobalt is also used in the manufacture of jet engine turbines and military technology, wear resistant and high strength steel alloys, as well as high speed steels and magnets.

New technologies of smartphones and other innovative gadgets like iPads also require lithium-ion batteries — of which cobalt is a major ingredient.

The early stage HGM will be looking to supply all these markets and sees plenty of blue sky ahead.

However, how much of the market HGM can attract remains to be seen, so investors should still approach their investment decision with caution and take all publicly available information into account when making that decision.

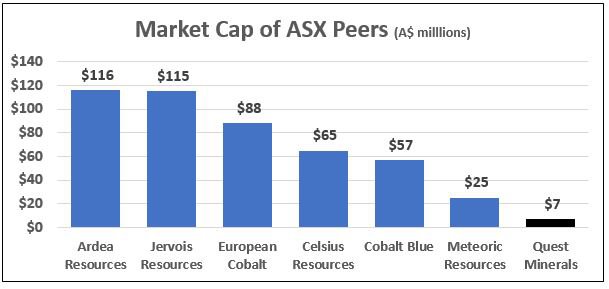

With a market cap of just $7.7 million…

…HGM is flying under the radar

Junior cobalt companies are certainly one way to bet on the future of the already booming demand for cobalt ….especially those holding a highly prospective portfolio of projects.

Compared to its European cobalt-seeking peers, HGM has very high grade deposits. Yet, as you can see below, HGM is valued much lower by the market. This is a comparison of the market cap of other ASX-listed cobalt juniors.

Even after its recent share price rally, HGM has a market cap of just $7 million.Of course, this could all change rather quickly, at the benefit of existing shareholders.

HGM’s nearest peer, European Cobalt (ASX:EUC), reached a $99 million market cap after rising by more than 660% over the past year. It currently sits at $87.6 million. EUC’s spectacular share price rise can be attributed to the positive newsflow coming out of its flagship Dobsina cobalt project in Slovakia.

Interestingly for HGM shareholders, while EUC’s Dobsina project is certainly more advanced than that of HGM, its cobalt grades are less impressive.

This augurs well for HGM’s cobalt ambitions, but its share price may also be affected by the other ace up its sleeve:

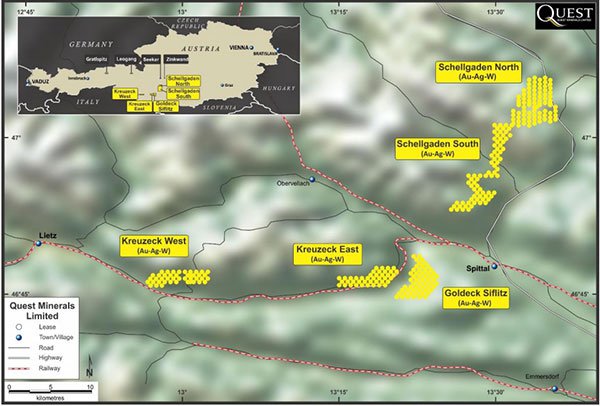

HGM’s Austrian Gold Projects

The Austrian Gold Projects comprise five exploration concessions made up of a total of 300 Exploration Permits, covering a total area of approximately 170 square kilometres.

The five exploration concessions are:

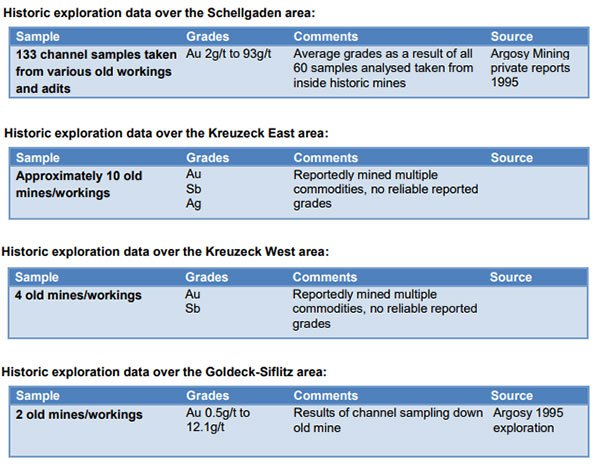

Below are the key exploration results for the Austrian Gold Project areas. Modern exploration has not taken place over these exploration areas, and the bulk of the reported samples based on historical references are rock chip and core samples.

- Schellgaden North - 36 Exploration Permits

- Schellgaden South - 121 Exploration Permits

- Kreuzeck West - 44 Exploration Permits

- Kreuzeck East - 42 Exploration Permits

- Goldeck-Siflitz - 57 Exploration Permits

There are multiple deposit types in the Austrian Gold Projects, all with proximity to excellent basic infrastructure such as roads, towns and services.

However, the immediate (gold) focus is at the Schellgaden (North and South) project.

There have been over 30 historical mines and workings at Schellgaden over a 30 kilometre strike length. Yet these historic resources are still to be systematically appraised using modern techniques.

Samples taken from the former underground mine at the Katschberg locality, which is within the Schellgaden tenure, yielded gold grades of up to 93 grams per tonne.

This project is referred to in historical records as a high-grade gold mine. This reference is somewhat supported by the results of the Argosy Mining GmbH channel sampling program that was completed in the mid-1990s.

Just as HGM has big plans for its place in the cobalt market, so too is it expecting big things from its gold projects.

Why HGM is in the Gold market

Total global demand for gold was 2004 tonnes in the period from January to June last year. It was down from 2318.7 tonnes in the same period a year earlier. But due to elevated geopolitical tensions as well as economic uncertainty in developed economies the gold price is set to stay supported.

Of course, gold prices do fluctuate and investors shouldn’t rely on commodity prices alone. Seek professional financial advice before making an investment decision.

Purchases of gold bars and coins were up 13%, in the six months to mid-2017. This was due to increasing demand in China, India and Turkey. On top of that, jewellery purchases rose 8% over April-June as buying rebounded in India and Turkey’s economy stabilised.

So, as you can see HGM is advancing in two markets with significant potential: both cobalt and gold are riding strong waves and HGM could have the projects to match.

2018 could be the year it proves its worth.

What’s next for HGM?

HGM plan to undertake a two year exploration program, focusing on the highly prospective cobalt/nickel/copper mineralisation of the Leogang and Seekar projects and the high grade gold potential of the Schellgaden gold mine.

It is focused on defining Resources, completing studies and moving quickly into production.

For now, HGM is focused on finalising the acquisition as well as creating its first cashflow as quickly as possible.

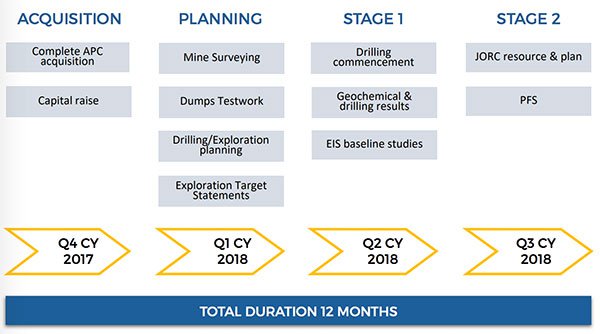

Here is the company’s plan of action for the coming year:

Announcements regarding a scoping study/prefeasibility study should be seen within 18 months, subject to results and budget.

Evidently, there should be a constant stream of news flow to come from HGM as it looks to cement its position as a strong cobalt player with an eye to having some influence on macro European trends.

Source:

https://www.nextsmallcap.com/demand...ks-prospective-austrian-cobalt-gold-projects/

- Forums

- ASX - By Stock

- Ann: Investor Presentation

Demand Soars as ASX Junior Picks Up Prospective Austrian Cobalt...

-

- There are more pages in this discussion • 2 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)