Manganese is an abundant resource that is embedded in the ground of the Earth, and that has numerous applications. The most known is steel and metal alloy making, in which manganese improves the strength and the properties. Therefore, 90% of all manganese consumed goes into steel as an alloying element. After steel, the second most important market for manganese is primary and rechargeable lithium-ion batteries.

Despite its ubiquity, manganese is rarely found in high enough concentrations to form an ore deposit. Of the hundreds of minerals containing manganese, only around 10 are of mining significance. Global manganese reserves are predominantly located in South Africa, Gabon, Brazil, and Australia, which combined, supply over 90% of the global consumption.

There are also large manganese reserves on ocean floors at a depth of approximately 5,000 metres in the form of nodules. However, ‘mining’ these nodules is difficult and very expensive. Notwithstanding, given the increasing demand for EV batteries, they are now considered a potential long-term resource for the future.

Global Production

Manganese is produced and traded globally in five major categories:

- Manganese Ore – Global output of manganese ore increased in 2017 to 18.6 million mt (Mn contained), up by 23% YoY.

- Silico-Manganese – Global production of silico-manganese increased in 2017, reaching a record high of 13.8 million mt. a 10.5% increase YoY.

- Ferro-Manganese – In 2017, production stood at 5.8 million mt, an 18% increase YoY.

- Electrolytic Manganese Metal (EMM) – Global production in 2017 increased by 37% YoY to 1.74 million mt.

- Electrolytic Manganese Dioxide (EMD) – Global production in 2017 reached 400,000 mt, a 4% YoY increase.

Applications

Industrial and Metallurgical Steel produced from iron contains a high amount of oxygen and some sulphur. Manganese plays a key role because of its ability to combine with sulphur, and its powerful deoxidation capacity. Without manganese, steel would have a low melting point. Around 30% of the manganese used today is for this purpose. The other 70% is used as an alloying element, depending on the desired properties of the end product. Adding manganese can significantly increase the strength of steel, and enhance resistance to rust and corrosion. Other metals like aluminum, copper, and nickel also benefit greatly from using manganese as an alloying element. For very specific applications, manganese can be mixed with zinc, gold, and silver.

Non Metallurgical Uses

Batteries

The most important non-metallurgical application of manganese is in batteries. Both disposable and rechargeable batteries use various forms and quantities of manganese in their construction.

Chemicals

Manganese has a multitude of chemical uses, such as:

- Purifying drinking water, treating waste water, and odour control. When manganese is combined with bactericide and algicide, it creates a powerful oxidizing agent

- Making agricultural fungicide, which is used to control crop and cereal diseases

- Treating uranium ore to produce the oxide-concentrate known as ‘yellow cake’

- Colouring bricks, tiles, driers, and being used as a pigment for paints

- Producing fertilisers and animal feed

- As an intermediate product in the chemical industry (when made into manganese sulphate)

- Contributing to the manufacture of television circuit boards, when used as manganese ferrite

Manganese in Lithium-Ion Batteries

Lithium-Ion Battery Overview

At a high level, the structure of a lithium-ion battery cell has three primary functional components: a positive electrode, a negative electrode, and an electrolyte in between. The negative electrode (anode) is made from carbon, the positive electrode (cathode) is a metal oxide, and the electrolyte is a lithium salt in an organic solvent.

The most commercially popular anode is graphite. The cathode is generally one of three materials: a layered oxide (such as lithium cobalt oxide), a polyanion (such as lithium iron phosphate), or a spinel (such as lithium manganese oxide). The electrolyte is typically a mixture of organic carbonates containing complexes of lithium ions. Depending on materials choices, the voltage, energy density, life, and safety of a lithium-ion battery can change dramatically.

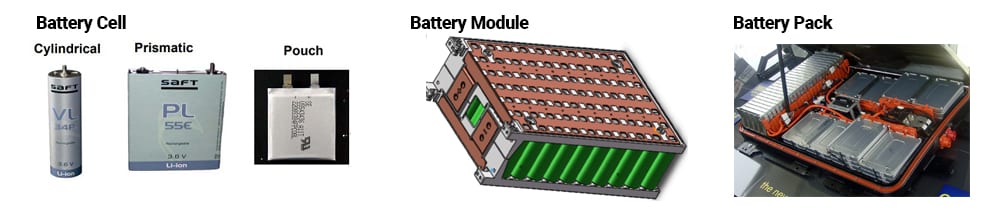

Lithium-ion battery cells come in three main form factors: cylindrical, pouch, and prismatic. A battery cell can be used individually, as in portable electronics, or combined in a sophisticated structure, like an electric vehicle (EV) battery pack, for example. It is important to note the specific terms when discussing lithium-ion batteries with three main distinctions.

A battery cell is the basic unit made from cathode, anode, and electrolyte. A battery module is a group of battery cells that are electrically and physically connected to each other to perform as a combined unit. A battery pack is multiple battery modules connected together and managed via a battery management system (BMS), and typically includes a cooling system and some other components. The figure below illustrates the three battery form factors and structure of a battery pack

Lithium-Ion Battery Chemistries

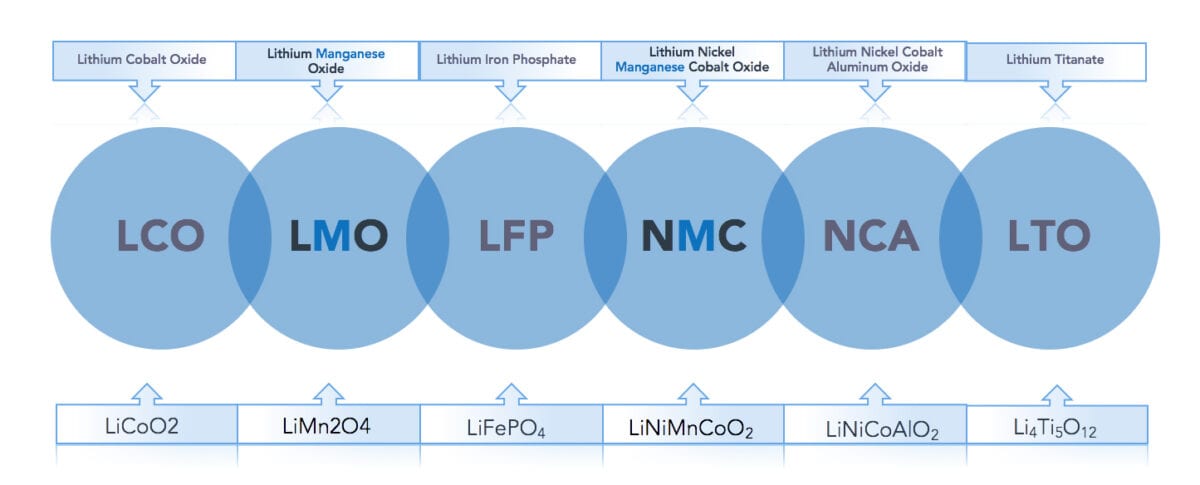

In terms of chemical composition, there are six types of lithium-ion batteries commercially available today. These are typically referred to by the chemical composition of the cathode as illustrated in figure 1. Manganese is an essential element in two of the six battery types: LMO (Lithium Manganese Oxide) and NMC (Nickel Manganese Cobalt), with the latter being the most prominent due to its balanced performance. The NMC battery is frequently referred to as the ‘all-rounder’ with good energy density, power output, thermal stability, charging time, and shelf life. Figure 1 shows a closer look at the two main manganese cathode chemistries.

Figure 1

Figure 1

Lithium-Manganese-Oxide (LMO) cathode

LMO batteries are notable for their high thermal stability, and are safer than other types of lithium-ion batteries. That is why they are often used in medical equipment and devices, and to power traditional phones and laptops, and EVs. Macquarie Research listed the market share of LMO cathodes in EVs in 2015 at 21%. However, market participants indicated that it has dropped since then, to the benefit of NMC cathodes.

LMO cathodes used in powering phones and laptops mostly use low-grade EMD (Electrolytic Manganese Dioxide) as a starting raw material, while high-grade EMD, or tri-manganese tetra oxide (Mn3O4), is consumed to make manganese oxide, which is then used in LMO cathodes for EVs. LMO cathodes usually contain around 60% manganese.

Nickel-Manganese-Cobalt (NMC) cathode

NMC cathodes (also called NMC for Nickel-Manganese-Cobalt) are used to power phones, e-bikes, power tools, laptops, and EVs. For example, Tesla Powerwall batteries, supplied by Panasonic, use NMC cathodes to store solar power for residential applications.

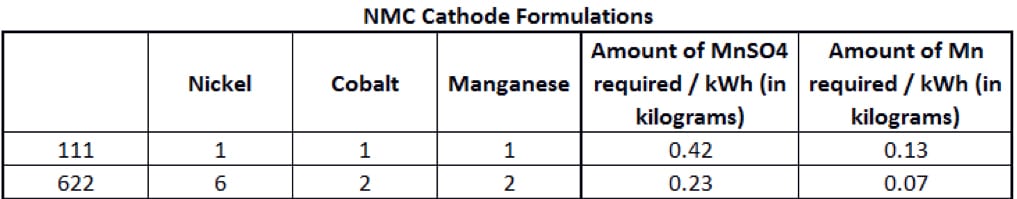

The manganese content of an NMC cathode depends on its formulation, based on the proportion of each metal (nickel-manganese-cobalt). Two of the main NMC cathode formulations are shown in Figure 2.

Figure 2

Figure 2

A standard NMC lithium-ion battery is called a 111, meaning it uses 1 third nickel, 1 third manganese and 1 third cobalt. But in an NMC 622 cell, the cathode is roughly 60% nickel sulphate, with the remainder split equally between manganese and cobalt. The main goal of battery chemists is to reduce the use of cobalt, as it is expensive and in limited supply with significant risks threatening the security of that supply. The Democratic Republic of Congo – plagued by decades of corruption and violence – produces more than half of the world’s supply. Rising demand amid the electric-vehicle boom and a lack of major alternative sources has seen prices more than triple since the start of 2016.

Nickel supply also concerns cathode manufacturers, as only a quarter of the nickel ore currently produced can meet the standards required for processing ore into nickel sulphate for cathode production. Nickel prices could become too high, as cathode manufacturer BASF forecasts EVs to account for up to half of nickel demand by 2025.

To significantly reduce the quantity of nickel and cobalt in its NMC cathodes, BASF aims to create ‘manganese-rich’ cathodes in the longer term, according to BASF’s senior vice-president, Hartmann Leube. But this will require extensive, costly research and development.

Tesla uses an NCA battery for its Model S, but is looking at an NMC combination going forward, with the 811 battery tipped as the favourite, according to market sources. These battery cells are leading the way in energy density and already have much lower costs than mainstream battery technology. However, the 811 formulation tests have not been very successful so far, so the viability of this NMC cathode with high nickel content and low cobalt and manganese content remains to be proven.

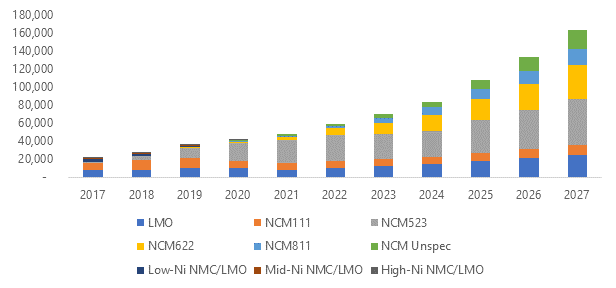

Looking at the different cathode chemistries, NMC batteries will probably continue to be favoured over LMO batteries. UK-based market research company, Roskill, has predicted that NCM523 chemistry will become the dominant cathode in the coming years as illustrated in Figure 3.

Figure 3

Figure 3

Roskill forecasts that manganese demand, just from lithium-ion batteries, will grow at a compounded annual rate of 23% from now until 2027. This growth will be largely underpinned by demand for NMC cathodes, driven by demand from the automotive sector.

Interest from the auto industry in manganese for the lithium-ion batteries used in EVs is rising, as Tesla could switch to manganese-based batteries in the near future. Tesla has also signed a five-year, exclusive partnership with Dr. Jeff Dahn, a prominent NMC researcher, to explore reducing the cost of its batteries. They’re not the only company that is looking into other battery options. LG Chem uses a 3M patented formulation of NMC and supplies its cells for use in the Chevrolet Volt and Nissan Leaf. BMW i3 also uses NMC batteries. General Electric, on the other hand, has selected the LMO battery as the best balance for safety and performance.

With more carmakers committing to turn a large proportion of their product line electric in the coming years, battery metals are under the spotlight, and manganese is finding a solid place in the race to provide battery technology. Supply will be a significant factor in the drive towards battery technologies that are more reliant on manganese, as it will drive the cost of the battery pack down, and as a result, bring the total cost of ownership of a battery-powered electric vehicle closer to that of an internal combustion engine vehicle.

Manganese-Based Materials for Battery Making

High-purity manganese sulphate (HP MnSO4)

MnSO4 is the main product used to make NMC cathodes for EVs. HP MnSO4 can be produced from different manganese products, but high purity EMM is preferred as the starting raw material. It is worth mentioning that the specifications of high purity EMM needed to produce HP MnSO4 at a competitive cost, are stricter than the standard EMM that is produced for the steel market. Standard EMM with 99.7% purity is currently trading at around $2,500/mt. High purity EMM however, is not traded publicly, but contract prices are significantly higher than those of standard EMM.

Electrolytic Manganese Metal

EMM (99.9% Mn) is used as a starting material for some NMC cathodes, but the vast majority of NMC cathodes are made from MnSO4, which is still made from EMM. The use of EMM for LMO cathode production is very small while the use of 99.7% EMM as one of the starting materials for MnSO4 production for battery cathodes is starting to grow despite the added cost. EMM prices have seen a significant increase in recent months as illustrated by the Figure 4.

Figure 4

Figure 4

The market share of the NMC cathodes was estimated by Macquarie Research to be around 23% of total EVs in 2015, but this share has increased over the last two years according to market participants. A lot of battery makers have switched to NMC batteries because of their lower cost and good capacity. In 10 years, as much as 80% of lithium-ion batteries will use NMC cathodes according to Cairn Energy Research.

Belgian metals producer Umicore also plans to expand its cathode manufacturing capacity to meet projected demand from the EV sector. The company will increase the output of cathode materials at its plant in Jiangmen in Guangdong province, China, with a new facility on a nearby greenfield site.

Manganese Ore Consumption in Batteries

Mn ore consumption from EMD represented 2% of global ore demand in 2017, while other Mn chemicals, including Mn3O5, Mn oxide, Mn sulphate, etc., represented 2% of total Mn ore consumption in the same year. EMM accounted for 12% of global ore demand, with the remaining 86% consumed by manganese alloys to make steel. Manganese-based batteries are mainly produced from manganese chemicals, and to a smaller extent from manganese metal.

To conclude, with the rising global adoption of battery-powered EVs, demand and consumption of battery metals is expected to grow ten-fold by 2020 according to Bloomberg NEF, and manganese demand from the battery sector is likely to ride this wave for years to come. It will remain a niche market compared to steel applications, but it’s a premium market where battery-grade manganese products enjoy a much healthier margin than that of the traditional steel applications.