Here is Matt Bohlsen's excellent monthly Cobalt report. Suggest you also read the first comment at the end about the growing risks of DRC mining:

Cobalt Miners News For The Month Of October 2018

Oct. 26, 2018 1:08 PM ET|2 comments|Includes: AEOMF, AMSLF, ARRRF, ARTTF, AZRMF, BBBMF, BHP, BKTPF, BPLNF, BRCSF, BRVVF, BXTMD, CBBHF, CBLLF, CMCLF, CSSQF, CTEQF, ECSIF, FCX, FQVLF, FTMDF, FTSSF, GBLEF, GLCNF, GMRSF, HLPCF, HNLMF, IIDDY, KATFF, KBGCF, MCRZF, MLXEF, NDENF, NILSY, NZRIF, OZMLF, PANRF, PLM, PTNUF, RGARF, RNKLF, SHERF, SMMYY, SNNAF, UMICY, USCFF, WCTXFInvestment advisor, portfolio strategy, growth at reasonable price(12,525 followers)Summary

Cobalt spot prices were slightly down in October.

Cobalt market news - NMC batteries dominating EV – sales to reach 63% of global market. Cobalt supply is expected to struggle to meet demand after 2022.

Cobalt miners news - Nornickel teams up with BASF, and Umicore teams up with Norvolt and BMW.

Looking for more? I update all of my investing ideas and strategies to members of Trend Investing. Get started today »

Welcome to the October 2018 cobalt miner news. For some background on the cobalt miners, please check out my earlier articles:

- May 2016 - "Cobalt Miners Set To Boom"

- December 2016 - "A Look At The Junior Cobalt Miners"

- December 2016 - "Top 5 Cobalt Miners To Consider"

- March 2017 - "Top 3 Cobalt Miners To Accumulate"

- September 2017 - "Top 3 Cobalt Juniors To Consider"

- January 2018 - "3 Well-Valued Cobalt Miners To Buy Right Now"

- April 2018 - "A Look At The Junior Cobalt Miners In Early 2018"

- August 21, 2018 - "Top 5 Cobalt Miners To Consider After The Recent Pullback"

The past month saw weak sentiment continue in the cobalt sector not helped by US-China trade war concerns. The cobalt price fall since March appears to have stabilized.

Cobalt price news

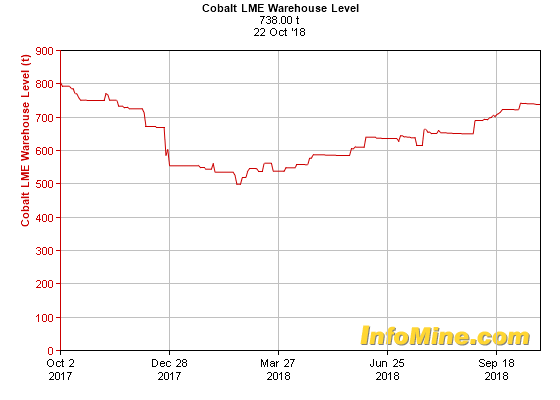

As of October 22, the cobalt spot price was US$27.56, reduced from US28.46/lb last month. The LME cobalt price is US$60,250/tonne. The London Metals Exchange [LME] inventory remains low and moved sideways for the past month (see graph below).

Interesting to note that cobalt prices are basically back to where they were in January of this year after peaking in March.

Cobalt spot prices - 1-year chart - USD 27.56/lb

Source: InfoMine.com

LME cobalt 1 year inventory

Source: Infomine.com

Cobalt demand and supply

On October 15 Investing News reported:

Korean battery makers SK Innovation (KRX:096770) and LG Chem (KRX:051910) announced they are working on nickel-cobalt-manganese 811 cathode/cells for electric vehicles, but pushed back commercial production during the third quarter, highlighting the difficulties of using new chemistry for batteries. According to Benchmark Mineral Intelligence, the challenges around introducing this technology are tougher than many expect — the London-based firm doesn’t see the change having a material impact on the supply chain before 2020 in China and 2021 in the international market.

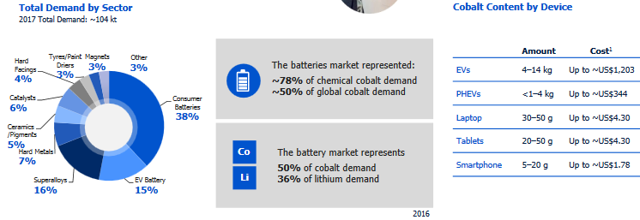

An interesting chart I came across this month from Cobalt27's investor presentation is shown below. Noting that EV battery demand as a percentage of total cobalt demand in 2017 was only 15%. Of course this percentage is set to grow exponentially. My cobalt demand model is forecasting total cobalt demand to rise from 133ktpa in 2017 to 373ktpa by end 2025 assuming electric cars reach 15% market share by then. That represents a 2.8 fold increase in cobalt demand in the next eight years. Given the constrained supply chain this will put pressure to find new supply especially after 2022.

In 2017 just 15% of cobalt demand came from EV batteries - This is set to grow exponentially

A recent Mining News article confirms my own model findings and states:

Cobalt heading towards 2020s deficit. The price of cobalt may have retreated from the dizzy heights of early 2018, but the outlook for the blue metal remains positive, with some sector analysts particularly bullish about prospects beyond 2020. Cobalt supply is expected to struggle to meet demand after 2022.

Cobalt market news

On October 5 Reuters reported: "London Metal Exchange moves to ban tainted cobalt. The London Metal Exchange is preparing plans that will allow it to clamp down swiftly on cobalt brands on its approved list thought to be tainted by human rights abuses, the exchange’s chief executive Matt Chamberlain said."

On October 5 Global Risk Insights released: "DRC Cobalt: A potential Achilles Heel of electric vehicles. In the private sector, automakers have announced large-scale plans to electrify their fleet of vehicles. For example, Volkswagen aims for a quarter of its vehicle production to be electric by 2025. The growth of electric vehicles and renewable energy technologies—the largest energy shift in a century–could depend largely on the availability and cost to produce and refine cobalt."

On October 12 Mining Weekly reported: "Congo miners seek concessions in new code as arbitration on hold." At stake are the new 10% royalties on cobalt, and the 50% profits tax. So far the DRC government is not negotiating.

On October 19 Visual Capitalist released: "Battery megafactory forecast: 400% increase in capacity to 1 TWh by 2028." The data is courtesy of Bencmark Mineral Intelligence.

On October 20 Mining.com reported:

NMC batteries dominating EV – sales to reach 63% of global market. NMC cathodes currently account for nearly 28% of global EV sales, forecast to grow to 63% by 2027. NMC is the most popular of the chemistries currently used in batteries by EV manufacturers, and market share is expected to expand dramatically in new EV sales, a new outlook for electric vehicle battery metals report published by Fitch Solutions reveals. The growing EV market will spur global demand for metals through their use in a wide range of chemistry combinations within the cathodes of lithium ion batteries. NMC-cathodes, a combination of nickel-manganese-cobalt, currently dominate the EV market, buoyed by high energy density and reliability. NMC cathodes currently account for nearly 28% of global EV sales, and Fitch forecasts that market share to grow to 63% by 2027. Fitch Solutions predicts that lower cost lithium iron phosphate [LFP] cathodes will continue to have a significant presence in the Chinese market, while Tesla-backed lithium nickel cobalt aluminium oxide [NCA] cathodes will attract interest from premium-segment manufacturers.

Cobalt company news

China Molybdenum [HKSE:3993] [SHE:603993] (OTC:CMCLF)

No significant news for the month.

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On October 23 Reuters reported:

US Justice Department demands details from Glencore on intermediary firms – sources. The investigation is not directed at Glencore's own activities or its senior executives, two sources told Reuters, giving no further detail about the type of information sought. "The investigation focuses on intermediaries," one source familiar with the probe said. A banker working with Glencore also said the focus was on three intermediary firms.

Katanga Mining [TSX:KAT] (OTCPK:KATFF)

No news for the month.

You can also read my original article from January 1, 2017, "Katanga Mining is a potential turnaround story." Followers of mine who bought back then with me at CAD 0.13 and sold when I recommended Trend Investing subscribers to reduce at CAD 2.89 made a nice 2,123% gain in just over a year.

Sherritt International [TSX:S] (OTCPK:SHERF)

No significant news for the month.

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

On October 15 Umicore SA announced:

BMW Group, Northvolt and Umicore join forces to develop sustainable life cycle loop for batteries. The BMW Group, Northvolt and Umicore have formed a joint technology consortium in order to work closely together on the continued development of a complete and sustainable value chain for battery cells for electrified vehicles in Europe. The project is seeking to press ahead with the sustainable industrialisation of battery cells in Europe and the associated acquisition of skills, from cell chemistry and development through to production and ultimately recycling.

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:SMMYY)

No news for the month.

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTCPK:NILSY)

On October 22 MMC Norilsk Nickel announced:

BASF and Nornickel join forces to supply the battery materials market. BASF announces first location for battery materials production in Europe. BASF and Nornickel establish a strategic cooperation to meet the growing needs for battery materials in electric vehicles." Reuters also reported: "Chemicals giant BASF will build a plant to produce cathode materials for batteries in Harjavalta, Finland, adjacent to a nickel and cobalt refinery owned by Nornickel, the world’s second-largest nickel miner and a major cobalt producer.

Investors can also read my article: "Time To Buy Norilsk Nickel Before The Nickel Boom Perhaps Starts In 2018, or my article "An update on Norilisk Nickel."

Freeport-McMoRan Inc. (NYSE:FCX)

On September 28 Freeport-McMoRan Inc. announced:

Freeport-McMoRan announces PT-FI divestment agreement with PT Inalum. Freeport-McMoRan Inc. announced today that it has entered into a Divestment Agreement on previously agreed economic terms with the Indonesian state-owned enterprise PT Indonesia Asahan Aluminium (Persero) (Inalum) in connection with Inalum’s acquisition of shares of PT Freeport Indonesia (PT-FI). As previously reported, Inalum will acquire for cash consideration of $3.85 billion all of Rio Tinto's interests associated with its Joint Venture with PT-FI (Joint Venture), and 100 percent of FCX's interests in PT Indocopper Investama (PT-II), which owns 9.36 percent of PT-FI.

Highlands Pacific [ASX:HIG] (OTC:HLPCF)

On October 8 Highlands Pacific announced:

Ramu Project. Highlands Pacific Limited has noted recent media reports regarding a potential expansion of the Ramu nickel and cobalt project in Papua New Guinea, in which Highlands holds an 8.56% interest (increasing to 11.3% upon repayment of project loans to Metallurgical Corporation of China Limited [MMC]). Highlands can confirm that MCC, the manager and majority partner in the Ramu joint venture, is investigating the expansion of the project which may cost in the order of US$1.5 billion. Details of any proposed expansion will be announced when they are finalised. The project has been achieving record rates of production and strong profitability in recent quarters and has recently increased its Ore Reserves and Mineral Resources and has plans for further drilling programs.

Of interest, 4-traders shows an analyst price target of AUD 0.33, representing 214% upside.

Possible mid-term producers (after 2021)

eCobalt Solutions [TSX:ECS] (OTCQX:ECSIF)

On September 27 eCobalt Solutions announced:

eCobalt announces retirement of Paul Farquharson and appoints new Chief Executive Officer. eCobalt Solutions Inc. announces that Mr. Paul Farquharson will retire as President, Chief Executive Officer ("CEO") and Director of the Board on October 1, 2018, and will be succeeded by Mr. Michael Callahan as President, CEO and Director of the Board.

Upcoming catalysts include:

- 2018 - Project financing and off-take agreements.

Fortune Minerals [TSX:FT] (OTCQX:FTMDF)

On October 4 Fortune Minerals announced:

Fortune announces NICO community education programs. Fortune Minerals Limited announces two community sponsorship initiatives to support education in the Northwest Territories ("NWT") as it advances its NICO Cobalt-Gold-Bismuth-Copper project toward construction. Fortune is pleased to be a co-sponsor, together with the NWT government, and other industry, community and education partners, in delivering the Prospectors and Developers Association of Canada ("PDAC") Mining Matters program to elementary schools in the NWT. The Company is also announcing funding for two educational awards for Tlicho students to participate in post-secondary studies in programs related to the resource industry.

Investors can read the latest company presentation here.

Upcoming catalysts include:

- H2 2018 - Updated Feasibility Study capital and operating costs

- 2018 - Possible off-take or equity partners; project financing

RNC Minerals [TSX:RNX] (OTCQX:RNKLF)(formerly Royal Nickel Corporation)

On October 2 RNC Minerals announced: "RNC provides Father's Day Vein high grade gold discovery update. RNC Minerals is pleased to announce that, after expected recovery of a high grade specimen slab from the top of the current Father's Day Vein stope later this week, mining operations are scheduled to resume in the area of the initial Father's Day Vein discovery."

On October 22 RNC Minerals announced: "RNC Minerals announces mobilization of first drill at Beta Hunt. RNC Minerals, is pleased to announce that the first mobile diamond drill has arrived at site and underground drill crews have started the gold exploration program at the Beta Hunt Mine near Kambalda, Western Australia."

On October 24 RNC Minerals announced: "RNC Announces Record Quarterly Gold Production of 31,360 ounces at the Beta Hunt Mine in Third Quarter of 2018." Note that the Q3 cut off date in Canada is September 31.

Investors can view the company presentations here, my very recent update on RNC Minerals article here, or my very recent CEO Mark Selby interview on Trend Investing here that discusses the Beta Hunt gold discovery and potential for more. Also a great article by Darp here.

H1, 2019 - Beta Hunt gold mine production report. Updated FS for Dumont results due out.

Clean TeQ [ASX:CLQ] [TSX:CLQ] (OTCQX:CTEQF)

On October 23 Clean TeQ announced: "Quarterly activities report–September 2018." Highlights include:

- "Appointment of Metallurgical Corporation of China Ltd [MCC] as a key project delivery partner for Clean TeQ Sunrise.

- National Instrument 43-101 Technical Report completed for Clean TeQ Sunrise, supporting the strong technical and financial outcomes of the Definitive Feasibility Study.

- Ongoing project financing and offtake discussions with a range of counterparties including global automobile and consumer electronics manufacturing companies.

- Clean TeQ Water nearing completion of several key projects including the waste water treatment projects in Oman and at the Fosterville Gold Mine in Australia.

- Formation of joint venture with Ionic Industries to progress graphene oxide membrane development."

Clean TeQ has 132kt contained cobalt at their Sunrise project.

Investors can also read my article, "Top 6 Cobalt Junior Developer Miners To Boom By 2021/2022", and the latest company presentation here.

Upcoming catalysts include:

2018 - Further off-take agreements and project funding.

Australian Mines [ASX:AUZ] (OTCQB:AMSLF)

On October 15 Australian Mines announced: "Australian Mines Limited is pleased to advise that the Northern Australia Infrastructure Facility [NAIF] Board has indicated it will move to investigate the potential for providing NAIF support for Australian Mines’ 100%-owned Sconi Cobalt-Nickel-Scandium Project located in Queensland."

Investors can read my recent update article here, my CEO interview here, or view the latest company presentation here.

Upcoming catalysts include:

- Q4 2018 - BFS result due for a Sconi. Project funding update.

- Late 2018/ early 2019 - First drill results for Thackaringa.

- April 2019 - Resource upgrade for Sconi. Sconi construction hoped to begin.

- 2019 - Updated resource and a PFS for Flemington to commence.

- 2021 - Possible Sconi production start with a 3 year ramp.

Ardea Resources [ASX:ARL] (OTC:ARRRF)

On October 8 Ardea Resources announced: "High-grade nickel-cobalt mineralization extended at Goongarrie. Recent drilling results from the Pamela Jean Deeps confirm and extend the deeper high-grade mineralization. This zone is scheduled as the mining target during the payback period, to enhance project economics."

In total, Ardea has 405kt of contained cobalt and 5.46mt of contained nickel at their KNP project near Kalgoorlie in Western Australia.

Investors can view their latest company presentation here, and my latest update Ardea article here.

Upcoming catalysts include:

- H2 2018 - Goongarrie Resource & Reserve Upgrade.

- Mid 2019 - DFS results - KNP cobalt project.

- 2021 - Possible production start.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

During October Cobalt Blue released their 2018 Annual Report which you can view here. Chairman Biancardi states:

With over 15,000 metres of drilling planned to be conducted in the next six months, in parallel to a large-scale bulk testwork program, aimed to prove up our innovative processing technology, we believe that Cobalt Blue will have significantly derisked its project over the course of 2019. This will not go unnoticed within the global environment that remains hungry for our product.

On October 24 Cobalt Blue announced:

COB decides not to exercise its rights to proceed further under Thackaringa joint venture farmin earning period provisions. Notwithstanding COB’s decision, it will continue to hold its recently

upgraded and announced 70% beneficial interest in the project. COB will remain in the Thackaringa Cobalt Project as a Joint Venture

partner with BPL (30% beneficial interest). COB will now work with our

JV partner, BPL to progress the Thackaringa Cobalt Project through

development and feasibility studies, and assuming positive results, and

into the construction and ultimately production phases. COB will remain Manager of the Joint Venture.In total Cobalt Blue currently has 61kt of contained cobalt at their Thackaringa Cobalt Project in NSW, Australia.

My interview with CEO Joe Kaderavek is on Trend Investing here, with an updated interview discussing the LG deal here, and my update article here.

Upcoming catalysts include:

- H2 2018 - Possible further LG agreements (off-take, funding).

- H2 2018 - H12019 - Optimisation improvements on the PFS, drill results.

- End Q2 2019 - Resource update.

- H1 2020 - BFS to be released. Reach 85% farm in. Project approvals completed.

- 2022/23 - Possible producer.

Aeon Metals [ASX:AML](OTC:AEOMF)

Aeon Metals 100% own their Walford Creek copper-cobalt project in Queensland Australia. The 2012 JORC stated Indicated and Inferred Resources of 73Mt at 1.43% Cu equivalent containing: 296,000t of copper, 60,000t of cobalt, 623,000t of zinc, 626,000t of lead, 55moz of silver. Recent previous announcements have confirmed mineralization strikes at 4.6km and 7.4km along strike from the defined existing resource.

On October 4 Aeon Metals announced: "Continuity of high-grade Cu-Co mineralisation from Vardy Resource west into Marley Resource. WFDH313 32m @ 2.03% Cu, 0.17% Co, 2.57% Pb and 33gt Ag from 171m Incl 19m @ 3.20% Cu, 0.21% Co, 3.93% Pb and 38gt Ag from 183m."

On October 17 Aeon Metals announced: "High grade continues 5.7km west of resource. WFDH378 included: 19m @ 0.06% Co, 4.84% Pb, 4.23% Zn and 87gt Ag from 274m; 4m @ 0.08% Co, 24.1% Pb, 4.57% Zn and 209gt Ag from 296m; and 13m @ 3.73% Cu, 0.27% Co and 49gt Ag from 300m. Including 9m @ 5.1% Cu, 0.36% Co and 59gt Ag from 300m."

For more information you can read my article "Aeon Metals May Have A World Class Copper And Cobalt Sulphide Resource In Northern Australia."

Investors can view a 4-traders analyst consensus PT of AUD 0.53, and the latest company presentation here.

Upcoming catalysts include:

- 2018 - Further drilling and drill results, further upgrades to the resource.

GME Resources [ASX:GME][GR:GM9] (OTC:GMRSF)

GME Resources own the NiWest Nickel-Cobalt Project located adjacent to Glencore’s Murrin Murrin Nickel operations in the North Eastern Goldfields of Western Australia. The NiWest Project which has a total resource (0.8% Ni cut-off): 81Mt at 1.03% Ni and 0.06% Co (~75% in M&I categories) for an estimated 830,000 tonnes of nickel metal and 52,000 tonnes of cobalt.

No significant news for the month.

Investors can read the latest activities report here, or an excellent investor presentation here.

Havilah Resources [ASX:HAV] [GR:FWL]

Havilah 100% owns the Mutooroo copper-cobalt project about 60km west of Broken Hill in South Australia, with an average cobalt grade of 0.13% and 17,100 tonnes of contained cobalt in sulphide ore. They also have the nearby Kalkaroo copper-cobalt project. Havilah also has a 15% royalty on the Portia gold mine which assists their cash flow, and their soon to be developed North Portia gold project. They also have a massive iron ore project called Grants iron (within the Mutorroo area), and several other very promising exploration projects including the massive Jupiter Iron Oxide Copper Gold Target.

On October 16 Havilah Resources announced: "Grants Iron Ore Basin drilling commencing soon. 3,500 metre RC drilling program funded by SIMEC Mining to test iron ore mineralisation in the western portion of the Grants Iron Ore Basin."

Note: Investors can learn more by reading my article "Havilah Resources Has Huge Potential." You also can view my CEO interview here and the company presentation here.

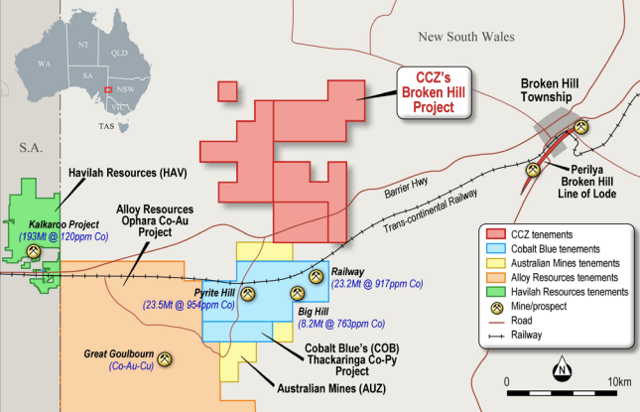

The very promising Broken Hill cobalt district (Havilah Resource's Mutooroo is not shown but would be at the bottom left if shown)

Note: Other neighbors to Cobalt Blue include Alloy Resources [ASX:AYR], Castillo Copper [ASX:CCZ], Broken Hill Prospecting [ASX:BPL], and Archer Exploration [ASX:AXE].

Castillo Copper [ASX:CCZ]

In an article titled "Castillo identifies six Himalaya-style cobalt targets" by Finfeed they stated: "CCZ’s project is situated 17 kilometres west of the historic Broken Hill mining centre, within a prolific region of NSW steadily emerging as a hub for battery metals. Broken Hill in particular is thought to contain one of the largest undeveloped cobalt reserves in the world, however previous exploration in the area has predominantly focused on zinc, lead and gold."

On September 28 Castillo Copper announced:

Assays infer polymetallic mineralisation potential at Broken Hill. Rock-chip assay results within the “Area 1” prospect at the Broken Hill project were up to 1,440ppm Co and 23,700ppm Cu. Within the tenure neighbourhood, highlighting the polymetallic mineralisation potential, historic near surface assays up to 17.7% Zn, 12% Cu, 8.2% Pb and 1,200ppm Co have been recorded1. CCZ has full mineral rights over the Broken Hill project and owns it 100%-outright.

On October 8 Castillo Copper announced:

Preliminary down-hole electromagnetic survey results identify several sizeable conductors. Preliminary interpretations of the data from the down-hole electromagnetic [DHEM] surveys conducted at Volkardts lode identified several sizeable conductors: The intersected massive sulphides in CC0023R1 delivered strong DHEM responses in-hole and in adjacent drill-holes. All evidence to date indicates that massive sulphides are the only source for these conductors.

Investors can view my CEO interview here and an investor presentation here.

Alloy Resources [ASX:AYR]

On October 18 Alloy Resources Limited announced: "Horse Well drilling underway. Aircore drilling campaign underway at Horse Well JV. Drilling to test soil anomalies north and south of Coralie Jean discovery and for extensions to Warmblood."

Cassini Resources [ASX:CZI] [GR:ICR] (OTC:CSSQF)

Cassini's flagship is the West Musgrave Project hosting over 1.0 million tonnes of contained nickel and 2.0 million tonnes of contained copper in resource. The company has a buy in JV with OZ Minerals [ASX:OZL] (OTCPK:OZMLF) for West Musgrave. The company also has several other promising projects.

On October 11 Cassini Resources announced: "OZ Minerals completes 51 per cent earn in for West Musgrave. Early metallurgical testing shows improvement in copper and nickel recoveries. Infill drilling program brought forward to enhance potential Feasibility Study schedule."

On October 23 Cassini Resources announced: "West Musgrave Project PFS update." Highlights include:

- "Resource Infill drilling returns best-ever Ni intersection at Nebo »23m @ 2.91% Ni, 1.13% Cu, 0.09% Co & 0.47g/t PGE (CZC0285).

- Thick, continuous zones of mineralisation intersected at Babel.

- Additional 23,000m of infill drilling brought forward into calendar 2018.

- Metallurgy program delivers significant improvements to nickel and copper recoveries.

- Substantial progress on environmental baseline studies.

- GR Engineering appointed to complete engineering design."

Investors can read the latest company presentation here.

Upcoming catalysts include:

- Q2 2019-PFS due.

Nzuri Copper [ASX:NZC] (OTCPK:NZRIF)

Nzuri 85% own the Kalongwe copper-cobalt project in the Kolwezi region of the Democratic Republic of Congo [DRC]. The Kalongwe resource is a near surface oxide resource of 302,000t contained copper at an average grade of 2.72% copper, that also includes 42,000t contained Cobalt (at an average 0.62% grade). In late 2017, China’s Huayou Cobalt invested US$10m in Nzuri Copper buying a 14.8% stake.

On October 3 Nzuri Copper announced: "Nzuri further strengthens pipeline of satellite resource targets with latest drilling At Monwezi 2. Copper mineralisation confirmed over +270m strike length–underpinning a maiden Exploration Target."

On October 22 Nzuri Copper announced: "Settlement of historical legal matters. Nzuri Copper Limited is pleased to advise that it has settled its ongoing dispute with Eucalyptus Gold Mines Pty Ltd. (Supreme Court of WA proceeding CIV 1885 of 2016) and with EGM and Murray James Longman (Supreme Court of WA proceeding CIV 2675 of 2017), prior to the trial which was scheduled to take place this week."

Investors can read the latest company presentation here.

Celsius Resources [ASX:CLA] [GR:FX8]

Celsius owns 100% of Opuwo Cobalt Pty Ltd, which in turn holds the right to earn up to 76% of the Opuwo Cobalt (sulphide) Project in Namibia. Mineralisation has already been intersected over a 15 km zone in the initial Celsius drilling program. Celsius has ~126,000 tonnes of contained cobalt at an average grade of 0.11%.

On October 4 Celsius Resources announced: "Shallow high grade cobalt potential at Opuwo." Highlights include:

- "Highlights from latest resource expansion drilling in the Western Zone are: 6 m @ 0.21% Co, 0.76% Cu and 1.15% Zn, including 1 m @ 0.50% Co, 0.92% Cu and 1.90% Zn: 4 m @ 0.26% Co, 0.40% Cu and 1.08% Zn: 6 m @ 0.16% Co, 0.62% Cu and 0.90% Zn, including 4 m @ 0.21% Co, 0.79% Cu and 1.08% Zn: 5.00 m @ 0.15 % Co, 0.48% Cu and 0.70% Zn: 5.22 m @ 0.14% Co, 0.45 % Cu and 0.64% Zn.

- All results outside existing JORC Mineral Resource.

- Data to be included in Mineral Resource update in Q4, 2018.

- Scoping Study remains on schedule for reporting before the end of October, 2018."

On October 4 Celsius Resources announced: "Opuwo Cobalt West Zone continues to develop."

Investors can view the company presentations here.

Barra Resources Ltd. (OTC:BRCSF) [ASX:BAR] / Conico Ltd [ASX:CNJ]

Barra is developing the Mt. Thirsty project, which is a 50/50 joint venture with Conico, to produce cobalt suitable for the metal, chemical and battery markets.

On October 22 Barra Resources Ltd. announced: "Excellent progress on Mt. Thirsty PFS work." Highlights include:

- "PFS level metallurgical test work results of the whole ore leach case by Wood independently validate the Scoping Study assumptions.

- Beneficiation test work successfully concentrates target asbolane mineral into one half of the mass and increases potential leach feed grades to as high as 0.33% cobalt.

- Technical and economic assessment identifies the whole ore leach case as superior to the beneficiation case on multiple financial and non-financial criteria.

- Whole ore leach selected as the go-forward case for the PFS.

- Optimisation of leach conditions underway aiming to further increase leach recoveries.

- Engineering to a PFS level of accuracy scheduled for Q1 2019."

Cruz Cobalt [CUZ] (OTCPK:BKTPF)

No news for the month.

First Cobalt [TSXV:FCC] (OTCQB:FTSSF)

On October 4 First Cobalt announced:

First Cobalt intersects high grade mineralization at Iron Creek. High grade copper [CU] intercepts include 10.0m of 4.04% Cu and 8.0m of 3.16% Cu, including 1.4m of 6.56% Cu and 20.5 g/t Ag; cobalt [CO] intercepts include 1.04% Co over 1.5m and 0.51% Co over 4.1m. Cobalt remains the dominant resource metal with higher grade cobalt zones towards the eastern extent of known mineralization and copper-rich zones to the west.

On October 10 First Cobalt announced:

First Cobalt assessing restart of Canadian refinery. Under a 24 tonnes per day (tpd) base case scenario, the refinery could produce 568 to 1,063 tonnes of cobalt per year; the study also considers an expansion scenario of up to 50 tpd. Permitting review concludes that a restart is possible within 18 months of selecting a feedstock under the base case scenario.

Investors can view the company presentations here.

Bankers Cobalt [TSXV:BANC] [GR:BC2] (NDENF)

On October 4 Bankers Cobalt announced: "Bankers reports high grade copper silver grab sample assay results from Kamanjab Project Namibia. 5.5% copper and 3 g/t silver. 24.6% copper and 98 g/t silver. 16.6% copper and 239 g/t silver."

On October 15 Bankers Cobalt announced: "Bankers reports virtual data room and investment banking advisor review."

Investors can view the company presentations here, or my CEO Stephen Barley interview on Trend Investing here.

Cobalt27 Capital Corp. [TSXV:KBLT] [GR:27O][LN:OUPZ] (OTC:CBLLF)

Cobalt27 is a listed investment company that offers unique exposure to a portfolio of cobalt assets - Cobalt metal, cobalt royalties and direct cobalt properties. Cobalt27 owns 2,905.7 tonnes of cobalt.

On October 9 Cobalt 27 Capital Corp. announced:

Cobalt 27 announces upgrade to OTCQX best market in the U.S. under the symbol CBLLF. “As the leading electric metals investment vehicle, Cobalt 27 offers direct exposure to metals integral to electric vehicles and grid energy storage systems. Trading on the OTCQX, will provide Cobalt 27 with a platform to expand our U.S. shareholder profile and allow a broader group of investors to participate in the global market for battery metals through Cobalt 27’s targeted cobalt and nickel metal streams, royalties and physical cobalt position,” commented Anthony Milewski, Chairman and CEO.

On October 19 Cobalt 27 Capital Corp. announced:

Cobalt 27 announces first blast at Voisey’s Bay mine expansion. Cobalt 27 Capital Corp. is pleased to announce that the Company has received confirmation from Vale of the start of the Voisey’s Bay transition to underground mining with the first blast at the Reid Brook portal rock face of the Voisey’s Bay Mine Expansion (the "VBME", and collectively, "Voisey's Bay"), located in Newfoundland and Labrador, Canada.

Investors can read my articles "Cobalt 27: Don't Forget The Nickel Exposure", and "Cobalt 27 Has A Rapidly Growing Portfolio Of 11 (Now 12) Cobalt And Nickel Streaming And Royalty Deals."

Other juniors and miners with cobalt

I am happy to hear any news updates from commentators. Tickers of cobalt juniors I will be following include:

African Battery Metals [AIM:ABM], Artemis Resources Ltd [ASX:ARV] (OTCPK:ARTTF), Auroch [ASX:AOU] [GR:T59], Azure Minerals [ASX:AZS] (OTC:AZRMF), Blackstone Minerals [ASX:BSX], BHP (NYSE:BHP), Berkut Minerals [ASX:BMT], Bluebird Battery Metals Inc. [TSXV:BATT] (OTCPK:BBBMF), Brixton Metals Corporation [TSXV:BBB](OTC:BXTMD), Canadian International Minerals [TSXV:CIN], Canada Cobalt Works Inc [TSXV:CCW], Centaurus Metals [ASX:CTM], Cobalt Power Group [TSX:CPO], Cohiba Minerals [ASX:CHK], Corazon Mining Ltd [ASX:CZN], Cudeco Ltd [ASX:CDU] [GR:AMR], Dragon Energy [ASX:DLE], European Cobalt Ltd. [ASX:EUC], First Quantum Minerals (OTCPK:FQVLF), Galileo [ASX:GAL], Global Energy Metals [TSXV:GEMC] (OTC:GBLEF), GME Resources [ASX:GME] (OTC:GMRSF), Global Energy Metals [TSXV:GEMC] [GR:5GE1] (GBLEF), Hinterland Metals Inc. (OTC:HNLMF), Hylea Metals [ASX:HCO], Independence Group [ASX:IGO] (OTC:IIDDY), King's Bay Res (OTC:KBGCF) [TSXV:KBG], Latin American Resources, LiCo Energy Metals [TSXV:LIC] (OTCQB:WCTXF), M2 Cobalt Corp. (TSXV: MC) (OTCQB: OTCQB:MCCBF), MetalsTech [ASE:MTC], Metals X (ASX:MLX) (OTCPK:MLXEF), Meteoric Resources [ASX:MEI], Mincor Resources (OTCPK:MCRZF) [ASX:MCR], Northern Cobalt [ASX:N27], Pacific Rim Cobalt [BOLT:CSE], PolyMet Mining [TSXV:POM] (NYSEMKT:PLM), OreCorp [ASX:ORR], Power Americas Minerals [TSXV:PAM], Panoramic Resources (OTCPK:PANRF) [ASX:PAN], Pioneer Resources Limited [ASX:PIO], Platina Resources (OTCPK:PTNUF) [ASX:PGM], Quantum Cobalt Corp [CSE:QBOT] GR:23BA] (OTCPK:BRVVF), Regal Resources (OTC:RGARF), Hylea Metals (ASX:HCO), Sienna Resources [TSXV:SIE], (OTCPK:SNNAF), US Cobalt [TSXV:USCO] (OTCQB:USCFF), and Victory Mines [ASX:VIC].

Lithium & electric metals fund (ISIN DE000LS9L822) - Access via the Stuttgart stock exchange or wikifolio.com

The portfolio gives investors broad exposure across EV metals miners covering lithium, cobalt, nickel, rare earths, and graphite. I help as an analyst for the fund. The certificate is endless (open fund) and listed on the Stuttgart Stock Exchange, so it can be bought via a broker that carries the ISIN or via Wikifolio. The ticker is DE000LS9L822 listed on the Stuttgart stock exchange and accessible from any German exchange. The management fee is 0.95% pa.

Investors can view the portfolio holdings and learn more by accessing here.

Disclosure: I may receive 50% of the profit from the above fund.

Conclusion

Cobalt spot prices were slightly lower again in October, having fallen since March. Prices appear to be stabilizing just below the USD 30/lb mark. Inventory levels remain low with little change for the month. The peak EV season is coming in Q4 which should give a strong boost to cobalt demand and support cobalt prices. The sector is quite oversold and due for some recovery soon.

My highlights for the month were:

- London Metal Exchange moves to ban tainted cobalt.

- NMC batteries dominating EV – sales to reach 63% of global market.

- BMW Group, Northvolt and Umicore join forces to develop sustainable life cycle loop for batteries.

- BASF and Nornickel join forces to supply the battery materials market.

- RNC Minerals continued gold success at Beta Hunt.

- The Northern Australia Infrastructure Facility [NAIF] Board has indicated it will move to investigate the potential for providing NAIF support for Australian Mines’ 100%-owned Sconi Cobalt-Nickel-Scandium Project.

- Ardea Resources - High-grade nickel-cobalt mineralization extended at Goongarrie.

- Aeon Metals - Continuity of high-grade Cu-Co mineralisation from Vardy Resource west into Marley Resource.

- First Cobalt intersects high grade mineralization at Iron Creek.

- Bankers reports high grade copper silver grab sample assay results from Kamanjab Project Namibia. The best ones were 24.6% copper and 98 g/t silver. 16.6% copper and 239 g/t silver.

- Cobalt 27 announces first blast at Voisey’s Bay mine expansion.

As usual all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to go to the next level, sign up for Trend Investing, my Marketplace service. I share my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Recent Subscriber Feedback On Trend Investing",or sign up here.

My latest Trend Investing articles are:

- RNC Minerals CEO Mark Selby Discusses The Massive Beta Hunt Gold Discovery With Matt Bohlsen Of Trend Investing

- The Potential Ten Bagger Club - October 2018

Disclosure: I am/we are long GLENCORE (LSX:GLEN), KATANGA MINING [TSX:KAT], NORSILK NICKEL (LME:MNOD), HIGHLANDS PACIFIC [ASX:HIG], AUSTRALIA MINES [ASX:AUZ], FORTUNE MINERALS [TSX:FT], RNC MINERALS [TSX:RNX] , ARDEA RESOURCES [ASX:ARL], COBALT BLUE [ASX:COB], AEON METALS [ASX:AML], CASSINI RESOURCES (ASX:CZI) , HAVILLAH RESOURCES [ASX:HAV], CONICO LTD [ASX:CNJ], CRUZ COBALT CORP [TSXV:CUZ], BANKERS COBALT [TSXV:BANC], POSEIDON NICKEL [ASX:POS], ALLOY RESOURCES (ASX:AYR), CASTILLO COPPER (ASX:CCZ), CELSIUS RESOURCES [ASX:CLA], COBALT27 [TSV:KBLT].

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.

I may receive 50% of the profit from the Lithium & electric metals fund's (ISIN DE000LS9L822) management fee, due to providing analyst services to the fund.Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Recommended for you:

Comments 2

Add CommentHi MattExcellent review as always. .. There is no question that the oft quoted, "Cobalt Cliff" is looming as a potential squeeze on the already tight supply of Co supply. IMHO, it could happen much quicker for all the reasons you mention--and more. As we have discussed, I really would be nervous if I were depending exclusively on supply from the DRC, including Glencore's Katanga..

From a corporate risk perspective, concentrated supply.in one location will raise many red flags with the risk management crowd. And, it should. Think about it.. What could wrong in the DRC--some of the obvious and some that are not so obvious.

You have heard me before get very concerned over recent, well designed clinical studies that measure blood and urine levels 10 times higher in miners in villagers surrounding or working in the Cobalt mines in the DRC compared with a control group. The WHO is fully aware of these recent clinical findings and are alarmed. The WHO is not your little NGO group spewing propaganda.. The WHO is a serious health organization with clout.

So, IMHO security and human safety issues relating to human health is an emerging issue in the 2018-19 period. Tracking the chain of custody from any cobalt origin will be an absolutely necessity with a full proof reporting channel independent of operations that reports to third parties. . .

I am suggesting that companies find or develop independent qa/qc officer, or department that measures, reports, and randomly inspects all Cobalt mining and processing sites and reports independent of the operating group to the BOD and also to a Human Health and Safety Bureau at the WHO, or equivalent international regulatory body with power to stop work.

Regulatory bodies in local countries cannot be trusted to do the same task or maybe so understaffed it is practically impossible for the local reg body to perform such duties. So, the Companies must self regulate or it will be done for them with new sets of regulations.. You can take that to the bank.

What if the companies or the local governments just ignore the obvious.. and I am not talking about the previously reported multiple issues of abusive child labor practices. I am talking about marked toxicity--from heavy metals--the likes of which have not been seen since the the lead and mercury toxicity issues of several decades past.

My sources tell me that heads will no longer turn away in benign neglect. The general population living in the mining areas as well as the miners themselves are now subject of international concern. It is would not be unreasonable to expect intervention and mandatory tracing of all Cobalt stock coming from DRC to emerge--even if Glencore objects or turns it head.to the Chinese buyers most of whom snicker at Western Concerns..

We have all seen what happens when concerns in diamond mining reached international bodies. Let's hope we do not end up with a :"Blood Cobalt" debacle and what that would do to disrupt an already tight supply chain.

best, Dr. Mike -Miami. .Hi Matt,You might want to add Namibia Critical Metals (TSXV:NMI) who owns the tenements bordering Celsius Resources (ASX:CLA) to the west...Namibia Critical Metals has the same DOF along strike continuing into their property...

www.namibiacriticalmetals.com/...

ned50griswaldBefore you comment, why not add your picture?Add Your Comment: (NEW! Use @ to tag a user)Share your comment:PublishYour feedback matters to us!

- Forums

- ASX - By Stock

- AML $1.00/share

Here is Matt Bohlsen's excellent monthly Cobalt report. Suggest...

-

- There are more pages in this discussion • 2 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Add AML (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

0.5¢ |

Change

0.000(0.00%) |

Mkt cap ! $5.482M | |||

| Open | High | Low | Value | Volume |

| 0.0¢ | 0.0¢ | 0.0¢ | $0 | 0 |

Featured News

| AML (ASX) Chart |

Day chart unavailable