Share

322 Posts.

lightbulb Created with Sketch. 121

clock Created with Sketch. 31/05/18

17:19

Share

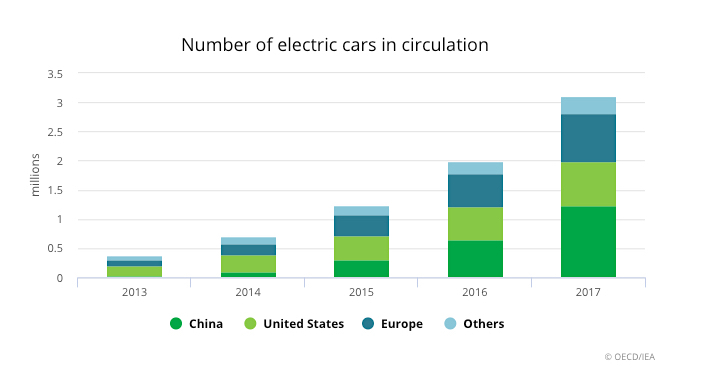

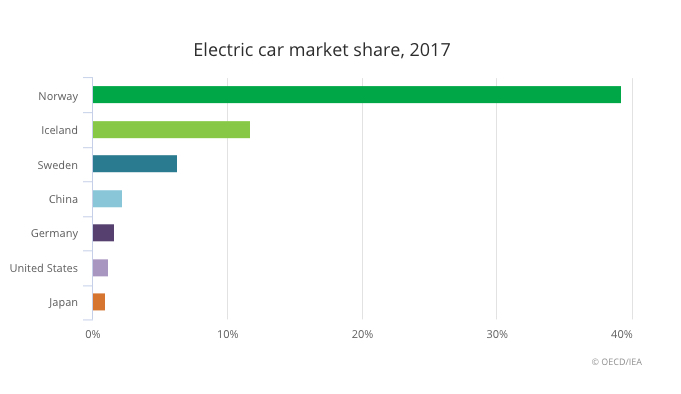

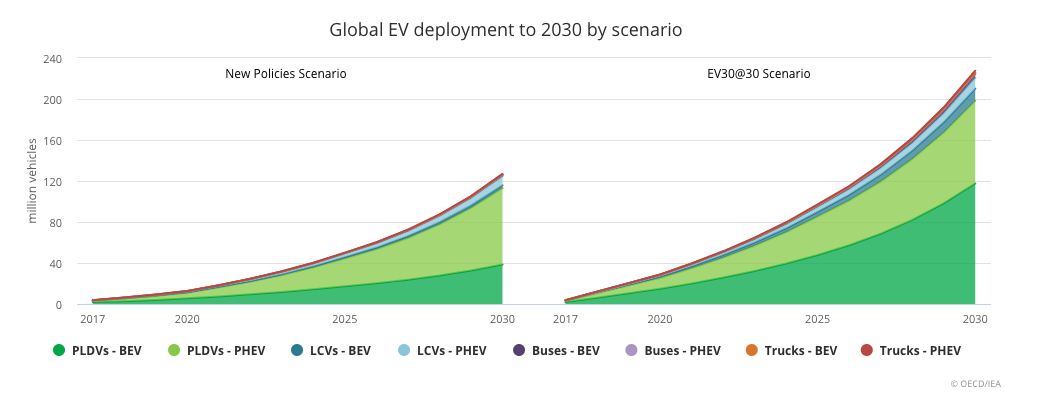

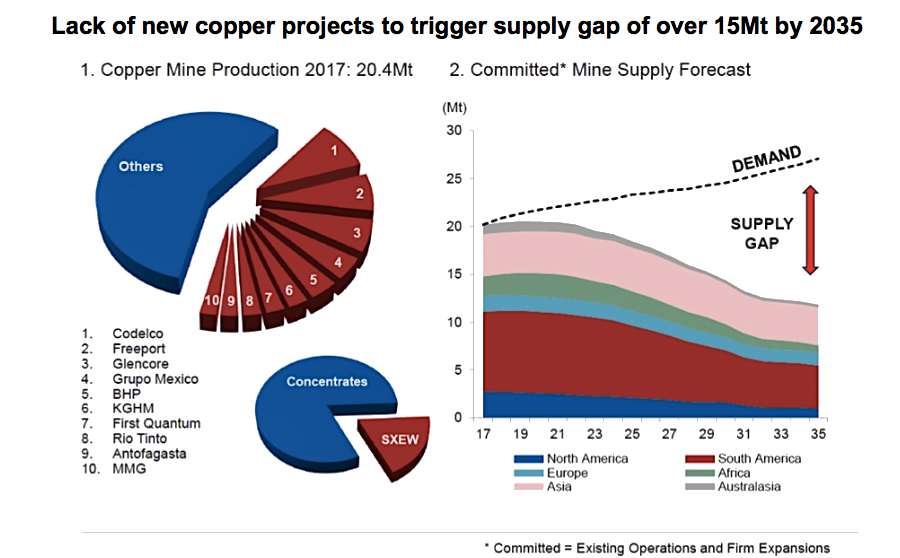

Electric vehicles on the road to triple by 2020 — IEA | MINING.comCecilia Jamasmie | about 18 hours ago | 0 PeopleMine Facebook LinkedIn Twitter Email Printhttp://www.mining.com/wp-content/up...ehicles-on-the-road-to-triple-by-2020-iea.jpg " class="img-responsive wp-post-image" alt="Electric vehicles on the road to triple by 2020 — IEA" srcset="http://www.mining.com/wp-content/uploads/2018/05/electric-vehicles-on-the-road-to-triple-by-2020-iea.jpg 900w, http://www.mining.com/wp-content/uploads/2018/05/electric-vehicles-on-the-road-to-triple-by-2020-iea-300x193.jpg 300w, http://www.mining.com/wp-content/uploads/2018/05/electric-vehicles-on-the-road-to-triple-by-2020-iea-768x495.jpg 768w" sizes="(max-width: 900px) 100vw, 900px" />Image: Sopotnick| Shutterstock. )said Wednesday .http://www.mining.com/wp-content/uploads/2018/05/number-ev-in-circulation.jpg " alt="Electric vehicles on the road to triple by 2020 — IEA" width="714" height="380" srcset="http://www.mining.com/wp-content/uploads/2018/05/number-ev-in-circulation.jpg 714w, http://www.mining.com/wp-content/uploads/2018/05/number-ev-in-circulation-300x160.jpg 300w" sizes="(max-width: 714px) 100vw, 714px" />Source: IEA’s Global Electric Vehicle Outlook 2018. http://www.mining.com/wp-content/uploads/2018/05/ev-market-share-2017.jpg " alt="Electric vehicles on the road to triple by 2020 — IEA" width="681" height="394" srcset="http://www.mining.com/wp-content/uploads/2018/05/ev-market-share-2017.jpg 681w, http://www.mining.com/wp-content/uploads/2018/05/ev-market-share-2017-300x174.jpg 300w" sizes="(max-width: 681px) 100vw, 681px" />Source: IEA’s Global Electric Vehicle Outlook 2018. A party for battery metals producers http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030.jpg " alt="Electric vehicles on the road to triple by 2020 — IEA" width="1046" height="403" srcset="http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030.jpg 1046w, http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030-300x116.jpg 300w, http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030-768x296.jpg 768w, http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030-1024x395.jpg 1024w" sizes="(max-width: 1046px) 100vw, 1046px" />Source: IEA’s Global Electric Vehicle Outlook 2018. http://www.mining.com/wp-content/uploads/2018/05/copper-supply-crunch-2035.jpg " alt="Electric vehicles on the road to triple by 2020 — IEA" width="900" height="558" srcset="http://www.mining.com/wp-content/uploads/2018/05/copper-supply-crunch-2035.jpg 900w, http://www.mining.com/wp-content/uploads/2018/05/copper-supply-crunch-2035-300x186.jpg 300w, http://www.mining.com/wp-content/uploads/2018/05/copper-supply-crunch-2035-768x476.jpg 768w" sizes="(max-width: 900px) 100vw, 900px" />Graph courtesy of Hamish Sampson | Analyst at CRU’s Copper Team. as early as next year .low investment in exploration .

"http://www.mining.com/wp-content/up...ehicles-on-the-road-to-triple-by-2020-iea.jpg" class="img-responsive wp-post-image" alt="Electric vehicles on the road to triple by 2020 — IEA" srcset="http://www.mining.com/wp-content/uploads/2018/05/electric-vehicles-on-the-road-to-triple-by-2020-iea.jpg 900w, http://www.mining.com/wp-content/uploads/2018/05/electric-vehicles-on-the-road-to-triple-by-2020-iea-300x193.jpg 300w, http://www.mining.com/wp-content/uploads/2018/05/electric-vehicles-on-the-road-to-triple-by-2020-iea-768x495.jpg 768w" sizes="(max-width: 900px) 100vw, 900px" />

"http://www.mining.com/wp-content/uploads/2018/05/number-ev-in-circulation.jpg" alt="Electric vehicles on the road to triple by 2020 — IEA" width="714" height="380" srcset="http://www.mining.com/wp-content/uploads/2018/05/number-ev-in-circulation.jpg 714w, http://www.mining.com/wp-content/uploads/2018/05/number-ev-in-circulation-300x160.jpg 300w" sizes="(max-width: 714px) 100vw, 714px" />

"http://www.mining.com/wp-content/uploads/2018/05/ev-market-share-2017.jpg" alt="Electric vehicles on the road to triple by 2020 — IEA" width="681" height="394" srcset="http://www.mining.com/wp-content/uploads/2018/05/ev-market-share-2017.jpg 681w, http://www.mining.com/wp-content/uploads/2018/05/ev-market-share-2017-300x174.jpg 300w" sizes="(max-width: 681px) 100vw, 681px" />

"http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030.jpg" alt="Electric vehicles on the road to triple by 2020 — IEA" width="1046" height="403" srcset="http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030.jpg 1046w, http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030-300x116.jpg 300w, http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030-768x296.jpg 768w, http://www.mining.com/wp-content/uploads/2018/05/global-ev-deployment-to-2030-1024x395.jpg 1024w" sizes="(max-width: 1046px) 100vw, 1046px" />

"http://www.mining.com/wp-content/uploads/2018/05/copper-supply-crunch-2035.jpg" alt="Electric vehicles on the road to triple by 2020 — IEA" width="900" height="558" srcset="http://www.mining.com/wp-content/uploads/2018/05/copper-supply-crunch-2035.jpg 900w, http://www.mining.com/wp-content/uploads/2018/05/copper-supply-crunch-2035-300x186.jpg 300w, http://www.mining.com/wp-content/uploads/2018/05/copper-supply-crunch-2035-768x476.jpg 768w" sizes="(max-width: 900px) 100vw, 900px" />

(20min delay)

(20min delay)