BloombergTechnology

Electric Car Demand Boosts Companies Engaged With Lithium

By

Jonathan Tirone

June 22, 2017, 12:00 AM EDTJune 22, 2017, 6:23 AM EDT

From

- Global X Lithium fund has outperformed benchmark indexes

- Investment surges in mining and processing the metal

A charging plug recharges the Nissan Leaf electric vehicle.

Photographer: Mark Elias/Bloomberg

Lithium demand is surging, boosting shares of the companies linked to mining and manufacturing the light metal used in electric-car batteries.

Global X Lithium & Battery Tech, an exchange-traded fund of the 27 biggest companies linked to the light metal, has increased 65 percent in the past 18 months, outperforming stock indexes of all the world’s most-developed economies, according to data compiled by Bloomberg.

“The acceleration in technology, including electric vehicles, could push new metals a lot higher,” said Eily Ong, an analyst at Bloomberg Intelligence who published a model on Wednesday probing the risk-weighted demand for metals including lithium.

Among those most heavily weighted in the Globe X fund are companies including Samsung SDI Co. and Panasonic Corp., which make the lithium-ion cells used in electric-car batteries, and automobile maker Tesla Inc.

Sales of electric cars rocketed to 2 million in 2016 after being virtually non-existent just five years ago. Mainstream carmakers from Renault-Nissan Motor Co. to Volkswagen AG are pushing ahead with emissions-free vehicles.

Manufacturing demand for lithium is feeding orders at mining companies including Sociedad Quimica y Mindera de Chile SA and Albemarle Corp., which also factor among the top 10 holdings at the Global X ETF.

New deposits are being tapped from Australia to Argentina as investors angle to make money from the transition away from fossil fuels and toward a low-emissions lithium-powered economy.

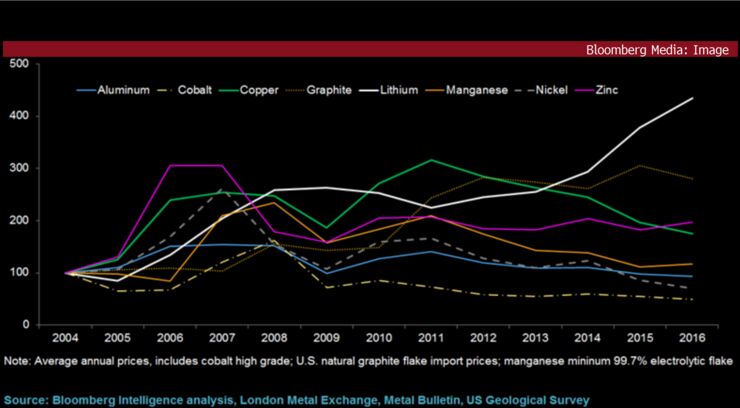

The scramble to open new lithium mines has struggled to keep up with demand, according to Bloomberg Intelligence. Prices for lithium carbonate jumped 335 percent between 2004 and 2016.

“A further increase in global electric-vehicle sales amid declining mining grades and possible production-cost inflation could boost higher new-tech metals prices,” BI’s Ong wrote in a note published Thursday.

Metals Price Performance (Indexed 2004=100)

lithium prices

Before it's here, it's on

- Forums

- ASX - By Stock

- LRS

- Lithium News

Lithium News

-

-

- There are more pages in this discussion • 8 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Add LRS (ASX) to my watchlist

(20min delay) (20min delay)

|

|||||

|

Last

19.0¢ |

Change

-0.010(5.00%) |

Mkt cap ! $560.2M | |||

| Open | High | Low | Value | Volume |

| 20.0¢ | 20.5¢ | 19.0¢ | $2.403M | 12.08M |

Buyers (Bids)

| No. | Vol. | Price($) |

|---|---|---|

| 9 | 426200 | 19.0¢ |

Sellers (Offers)

| Price($) | Vol. | No. |

|---|---|---|

| 19.5¢ | 953934 | 9 |

View Market Depth

| No. | Vol. | Price($) |

|---|---|---|

| 5 | 215700 | 0.175 |

| 6 | 630000 | 0.170 |

| 7 | 1125150 | 0.165 |

| 8 | 1918920 | 0.160 |

| 10 | 651683 | 0.155 |

| Price($) | Vol. | No. |

|---|---|---|

| 0.185 | 1869389 | 8 |

| 0.190 | 3947046 | 21 |

| 0.195 | 3325980 | 9 |

| 0.200 | 2906221 | 23 |

| 0.205 | 1881708 | 11 |

| Last trade - 16.10pm 08/11/2024 (20 minute delay) ? |

| LRS (ASX) Chart |