The world’s most polarising politician is back in power.

Donald Trump swept the 2024 US presidential election, comprehensively beating the Democratic candidate Kamala Harris on the promise of economic and societal reform.

The race was characterised by discourse around immigration, international tariffs and…cryptocurrency.

Both presidential candidates assured voters that much-needed regulatory clarity was coming for the Web3 scene under their power.

But Trump was the first to make crypto political, and his self-proclaimed title as the “Bitcoin President” has now become a reality.

So, just how much can the new US president accomplish for the industry – and how will crypto evolve?

How did the crypto market react to the news?

Despite both parties making crypto a focus of their campaigns, there’s been a long-standing belief that a Trump/Republican presidential victory would be bullish for digital currencies.

This is partially due to Biden’s previous term sowing distrust among the crypto community for Democratic representatives – as it was under his leadership the SEC’s “regulation by enforcement” policy became the status quo.

Additionally, Trump poured significant effort into swaying crypto’s swing voters, promising to transform the US into a hub for Web3 innovation.

And so, the very second it appeared that the Republicans were headed toward victory, the crypto market shifted into overdrive.

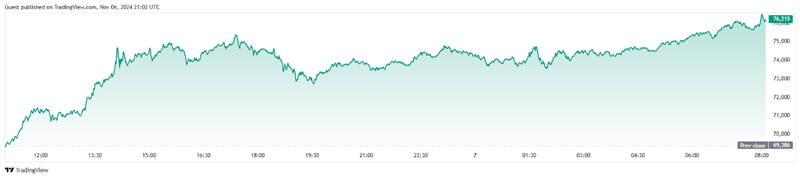

By the time it was official – Trump was president, again – Bitcoin had already ascended to post a new all-time high above US $76k (approx. AU $115,000).

BTC 1-day trading chart. Source TradingView.

BTC’s 10% daily gains were impressive but ultimately dwarfed by other top performers in the crypto market. Solana jumped 13%, Dogecoin 15%, Uniswap 30%, and Avalanche 11% since Fox News called Trump’s win.

All up, the global crypto market cap increased by 10.62% in the last 24 hours alone.

The short-term sugar rush of a Trump victory was expected by the crypto community, and we will have to wait and see how his term as president affects the market over four years.

Still, there’s no denying it’s off to a good start.

Will Trump keep his Bitcoin promise?

Pre-election promises aren’t always very reliable.

Time and time again the world has seen political campaigns run on a few key policies, only for their enactment to get blocked – or mutated – by bureaucracy, apathy or an unwillingness for real change.

Donald Trump made several grandiose promises for the crypto sector during his run for Office. So, let’s take a look at them piece by piece to see if he can deliver on his word.

- The SEC Chair Gary Gensler will be replaced. It is commonplace for positions of leadership to change when a new Government is elected. Trump said “On day one, I will fire Gary Gensler.” The newly appointed president does not have authority to do this, however, Gensler may himself resign given the circumstances.

- Creating a US Bitcoin Reserve. Speaking at a Nashville Bitcoin Conference, Trump promised to create the first official US stockpile of Bitcoin. The specifics are a little unclear, but it appears a likely outcome with supporter Senator Cynthia Lummis reaffirming the goal upon Trump’s election.

- All Bitcoin will be mined in America. This promise is a bit outlandish and has almost zero chance of becoming true – simply because Trump can’t really stop other nations from mining BTC. However, the broader sentiment of fostering Web3 innovation within the US is more realistic and local mining companies may experience strong growth.

How does November usually look for Bitcoin?

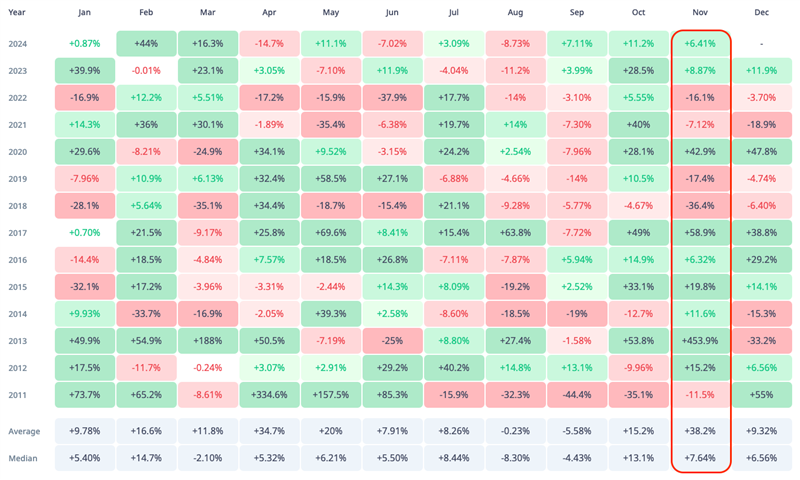

November has historically been a strong month for Bitcoin.

It has the second-highest median performance and highest monthly average (although this figure is warped by the 453% gains experienced in 2013).

Previous election years have been solid for Bitcoin too, despite varying outcomes.

Trump’s original victory in 2016 was met with 6.3% gains, while Biden’s 2020 presidency saw Bitcoin gain nearly 43%.

In 2024, BTC has already climbed 8.45% through November – a trend that may continue as the market settles in for a new US President.

Disclaimer:The information provided by Swyftx is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.